State Farm®

Mobile App

Always here to help

Simple and intuitive

The award-winning* State Farm mobile

app helps you manage your insurance and

banking accounts with ease, get roadside

assistance, file claims and more.

See for yourself. Download the State Farm mobile app today.

Text MOBILE to 78836 to get a link to download the app. Message and data rates may apply.

State Farm Mobile features

Manage your insurance policies

View a list of your policies and more - all in one place.

File and manage claims

Start your claim and take care of the details with ease.

Access your ID cards**

You don't have to search all over for your ID cards anymore. Access them when you need them.

Get roadside assistance

Whether you need a tow, a jumpstart, or a locksmith, help is just a few taps away.

Upload photos and documents

Upload photos and documents directly from your phone to help expedite your claims process.

Connect with your agent

Your agent is here to help when you need to talk to someone directly.

Support

For technical assistance call 888-559-1922888-559-1922.

Have questions? Check out our FAQ page.

Explore our other apps

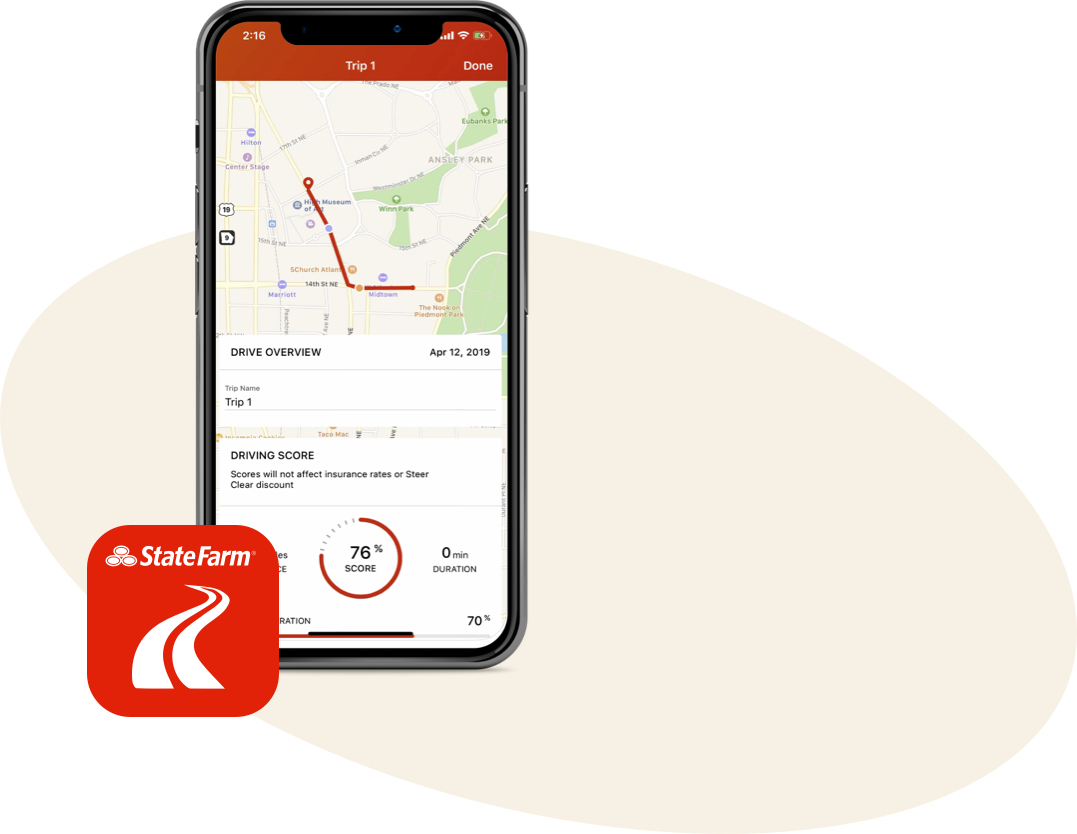

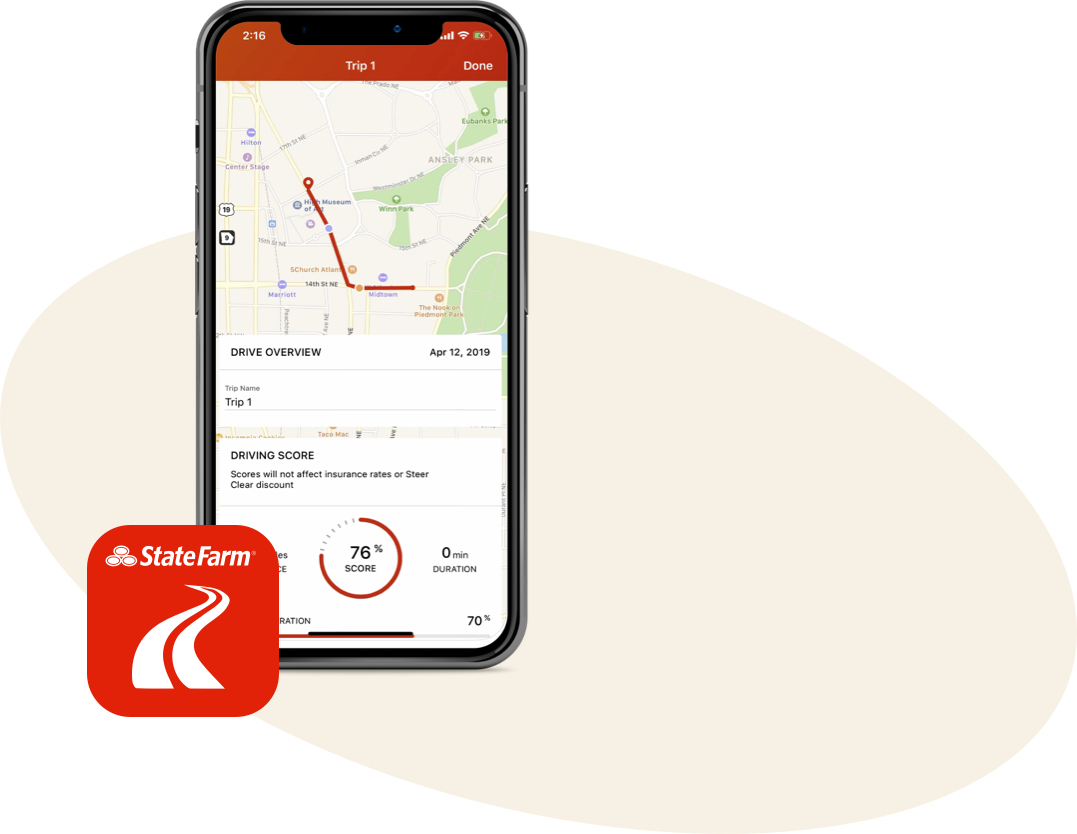

Drive Safe & SaveTM mobile

Your safe driving habits can earn you a discount.

Drive Safe & Save mobile collects basic information about your driving that may earn you a discount and save you some money.

Text SAVE to 42407 to get a link to download the

app. Message and data rates may apply.

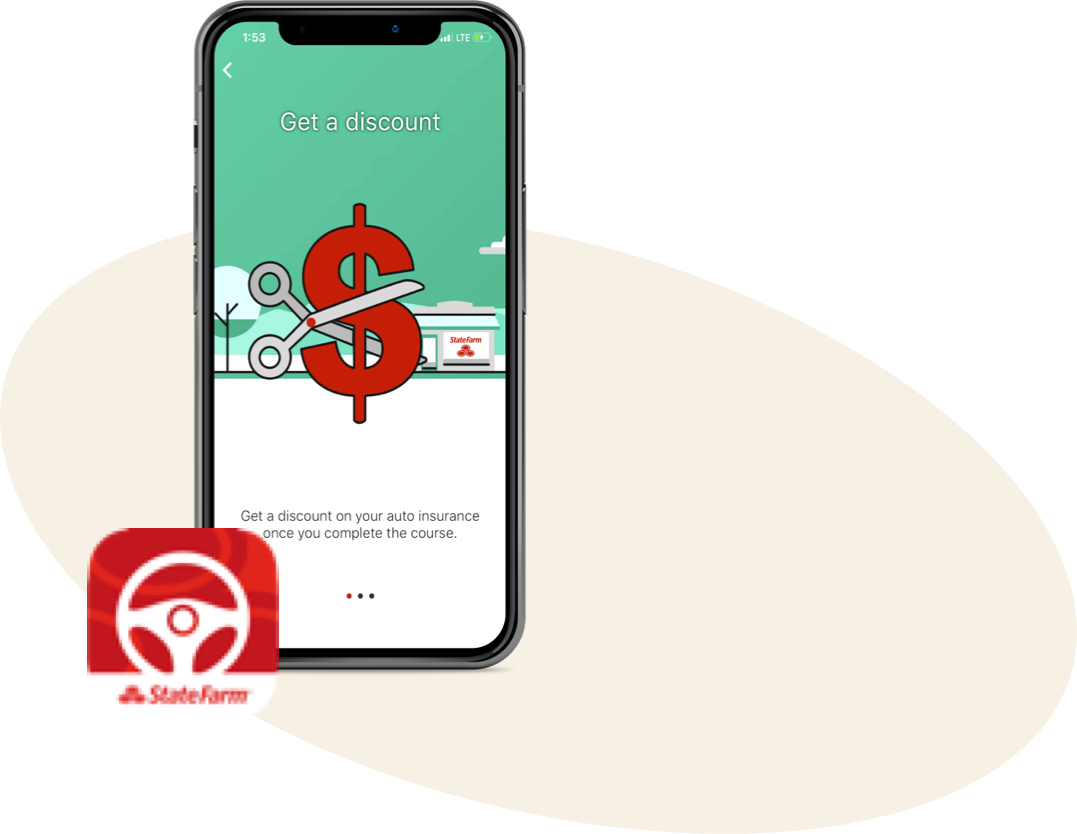

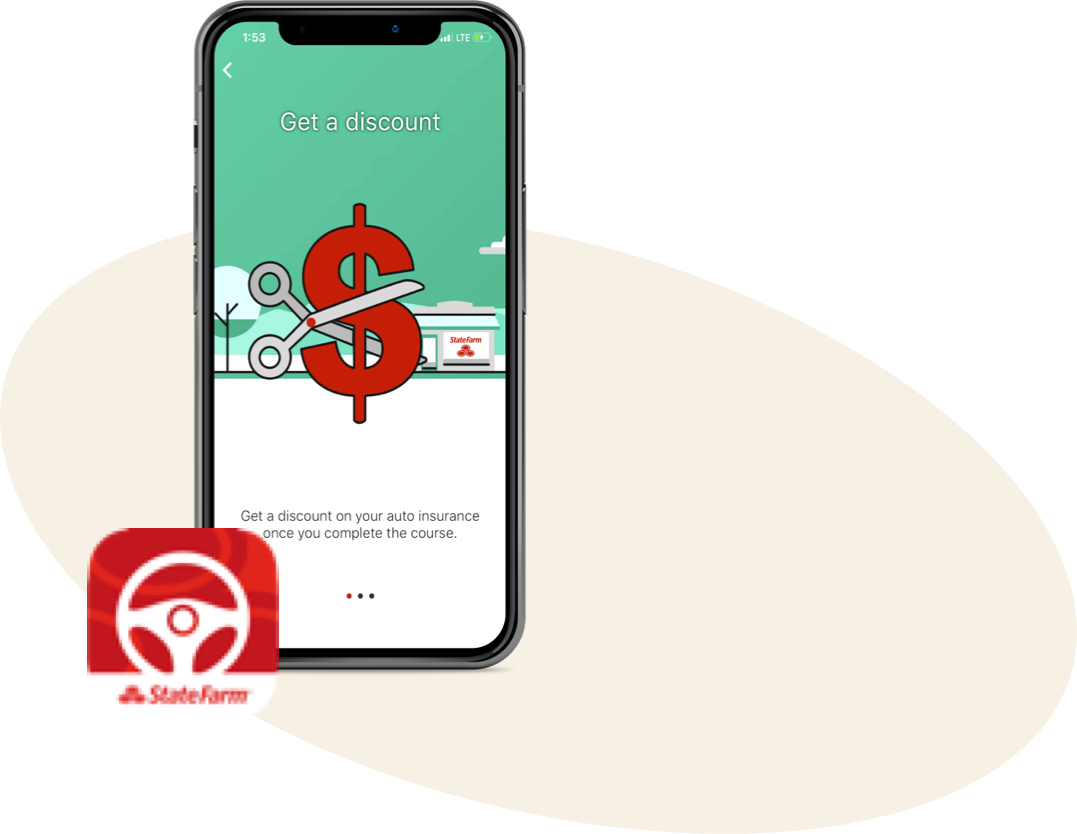

Steer Clear®

Safer driving is a priority for us.

Our Steer Clear app reinforces good driving habits in young drivers and helps them earn a valuable discount.

Text STEER to 42407 to get a link to download

the app. Message and data rates may apply.

*Return to reference2019 Mobile Web Award winner: Best Insurance Mobile App and Best Bank Mobile App

**Return to referenceThis may not be accepted by law enforcement officials as an insurance ID card in your state.

Compatible mobile phone required; enrollment and terms and conditions apply.

State Farm (including State Farm Mutual Automobile Insurance Company and its subsidiaries and affiliates) is not responsible for, and does not endorse or approve, either implicitly or explicitly, any third-party products or the content of any third-party sites referenced in this material. State Farm has no discretion to alter, update, or control the content on the third-party sites. Any references to such sites are provided for informational purposes only and are not a solicitation to buy or sell any of the products which may be referenced on such third-party sites. State Farm does not warrant the merchantability, fitness, or quality of the third-party products referenced in this material.

State Farm

Bloomington, IL