Divorce and finances

What to consider when navigating through your divorce and finances.

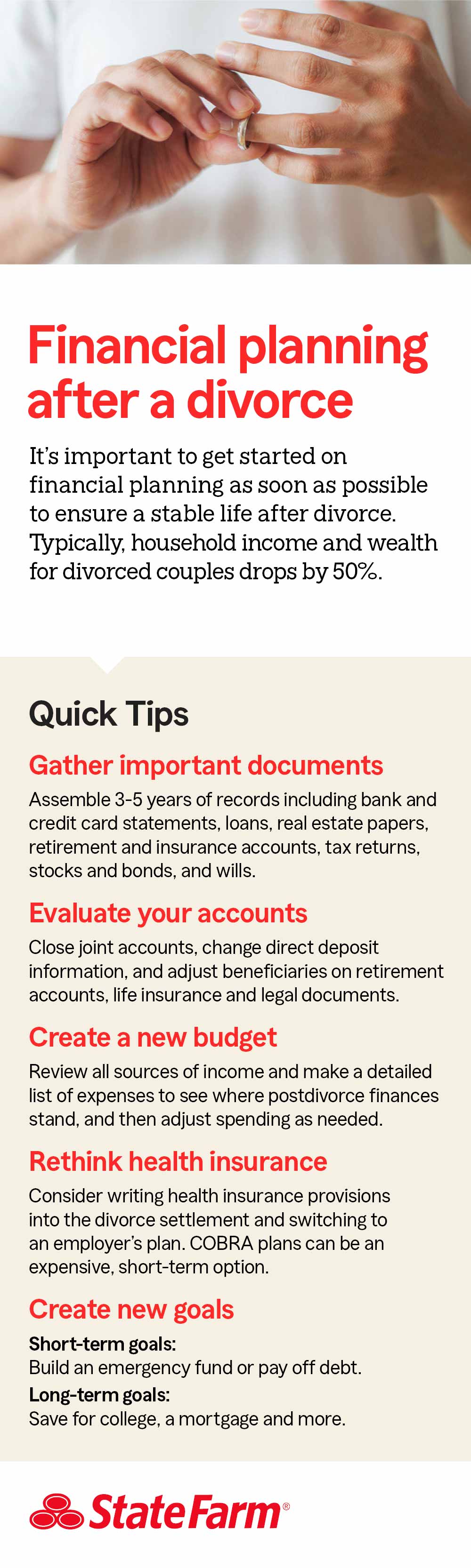

When someone gets married, the last thing they want to consider is how to get through a divorce financially. However, divorce can come at any age and at any stage of a marriage. One of the most important things you can do to help ensure a stable life for yourself after a divorce is to focus on getting your finances in order. This is why financial planning can be critical for starting over after a divorce.

As preparations for the divorce begin, it can be helpful to refer to a divorce checklist. Also, consider these areas as you approach financial planning during and after a divorce.

Understanding financial impacts

It’s important to understanding how the divorce will impact you financially. Since you’ll likely be going from two sources of income down to one, your single income might not be enough to maintain your standard of living. Hiring a financial professional might be a good option to help you through the financial process before you work on a divorce settlement agreement. Use this spending calculator to see what you're spending today and what you could be spending if adjustments were made.

Gathering important documents

When gathering important documents, the minimum number of years you'll want to go back is three. Documentation should include:

- Bank and credit card statements

- Loan paperwork

- Real estate papers

- Retirement account details

- Insurance documents and wills

- Stocks and bonds

- Tax returns

- A list of personal property and sentimental items

- A home inventory

Evaluating your accounts

Consider closing joint accounts, changing any direct deposits, and updating your address on accounts as necessary. It’s also important to consider whether beneficiary changes are needed for life insurance, retirement accounts and other legal documents including a will and power of attorney.

Creating a budget

Due to the impacts a divorce can have on your finances, it’s a good idea to consider creating a new monthly budget. Be sure to include everything from your water bill to medical bills to groceries and home repairs to your child's sports fees.

- Total up your expenses

- Total up your income

- Subtract your expenses from your income

- Determine if the net result is positive or negative

If the result is positive, that’s a good thing.If the result is negative, you may want to consider downsizing, or cutting back on things such as eating out, shopping, personal grooming or streaming services. You may also want to consider finding additional ways to supplement your income, such as getting a second job, to help cover your monthly expenses.

Rethinking health insurance

If you depend on your spouse for health insurance, you’ll likely need to find your own coverage after the divorce. If your employer offers a health insurance option, it’s a good idea to look into switching to your employer’s plan. Divorce is considered a life change that allows enrollment outside the typical enrollment period. COBRA insurance is another option, but it can be expensive.

Creating new goals

Planning for your financial future is key to moving forward, including setting short- and long-term savings goals.

- Short-term goals: It's a good time to start building an emergency fund if you don’t already have one. You may want to consider using extra funds to get out of debt as well.

- Long-term goals: You may also want to consider saving for college and/or saving for a mortgage.

Whether it’s a first divorce or not, it’s never an easy thing to get through. It’s a good idea to surround yourself with people who love and support you, and don’t forget to ask for help if you need it.