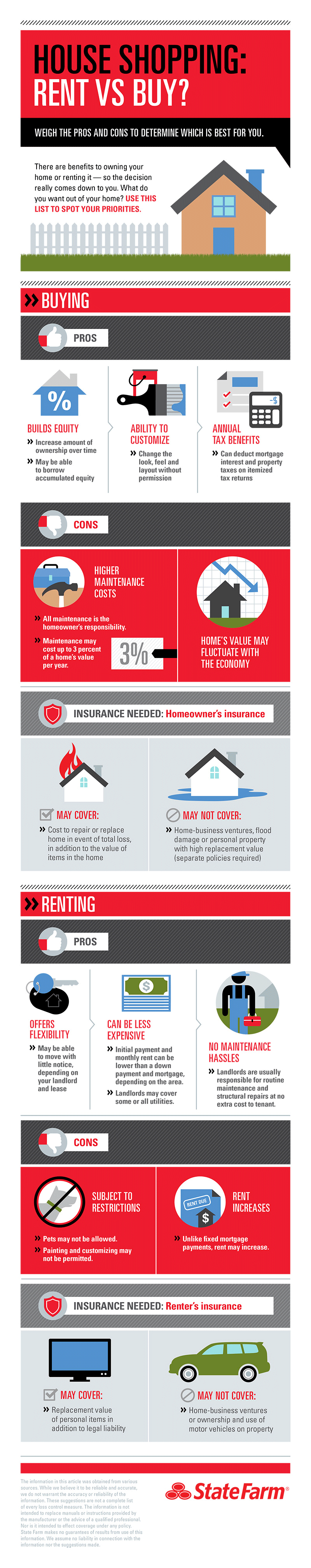

House shopping: Rent vs. buy?

Weigh the pros and cons to determine which is best for you.

Should you rent or buy? That's the big question you need to ask yourself before you go house shopping. The answer to that question depends on your priorities. Do you want to build equity or do you need to be able to relocate easily? To find out more about the benefits of owning a home versus the benefits of renting, check out our infographic. It'll help you decide.

Buying pros and cons

Pros

- Builds equity over time, and owner may borrow accumulated equity;

- Ability to customize the look, feel and layout of the home without asking permission; and

- Annual tax benefits like deductions for mortgage interest and property taxes.

Cons

- Higher maintenance costs are the homeowner's responsibility, and

- Home's value may fluctuate with the economy.

Insurance needed

- Homeowners insurance may cover the repair or replacement cost in the event of loss, and

- May also cover the value of the items within the home.

Renting pros and cons

Pros

- Offers flexibility if you want to move, depending on the landlord and lease;

- Can be less expensive, compared to a down payment on a home and mortgage; and

- No maintenance hassles, because those are usually responsibility of the landlord.

Cons

- May be subject to restrictions such as pets or customizing the home, and

- Possible rent increases, compared to fixed mortgage payments.

Insurance needed

- Renters insurance may cover the value of personal item within the home in addition to legal liability, and

- Renters insurance may not cover home-business ventures or vehicles on the property.