Built for the way you want to invest

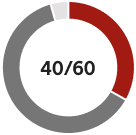

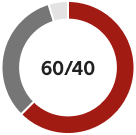

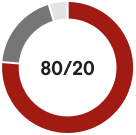

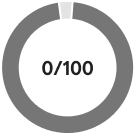

State Farm model portfolios can offer a diversified investment strategy that leverages low-cost exchange-traded funds (ETFs) and mutual funds built around an asset allocation framework targeted to meet your specific investment needs.

Work with your State Farm Investment Adviser Representative (IAR) to help determine which model portfolio could be right for you.