Stop livin’ on a prayer.

Get State Farm®.

Start livin' on State Farm

Now playing

Coverage cheat sheet

- Damage to another driver’s car or property if you’re responsible for an accident

- Damage or injury to others if you’re responsible for an accident

- Legal minimum coverage, requirements vary by state

- Your medical bills from an accident you caused

- Repairs to your vehicle after a crash

- Damage to your car

- Damage to third party's vehicle or property

- Natural disasters, theft, vandalism

- Natural disasters

- Theft

- Collision or vehicle rollover

- Injuries

Insurance details, simplified

Hear it from our customers

I liked the fact that I could complete everything online and do it quickly.Jacqueline

Very prompt help with locating a repair shop and obtaining a rental vehicleCynthia

Fast response and follow through. Personal contact with State Farm representatives. Available 24/7.Susan

Personalized coverage starts

with a conversation

there

there

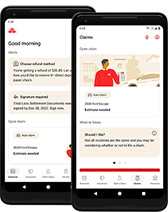

An award winning mobile app

- Manage your insurance

- Pay bills

- Contact your agent

- Start claims

19,000 local agents

Personalized protection starts with a conversation.

State Farm agents can help you choose the coverage that works best for you and potentially save money in the long run.

Find an agentTech that can save you up to 30%

How our Drive Safe & Save® program works:

- We get basic information about your driving

- You get safe driving feedback and maps of your trips

- Your driving determines how much you save.

- Safe drivers can save up to 30%.**

How is car insurance calculated?

Car insurance rates are group prices based on factors like age and location, reflecting expected claim costs.

Premiums are individual prices, starting from rates and adjusted for personal factors such as driving history.

Key factors affecting premiums:

- Age/Driving Experience: Younger (<25) and older (>65) drivers usually pay more.

- Location: High-traffic areas lead to higher premiums.

- Driving record: More violations increase costs.

- Claims history: Frequent claims raise premiums.

- Annual mileage: More driving means higher risk and cost.

- Vehicle type: Expensive-to-repair cars cost more to insure.

- Policy choices: Higher coverage limits and lower deductibles increase premiums.

- Telematics: Most companies offer optional rating plans that include your actual driving characteristics.

To help lower premiums, consider discounts for safe driving or bundling policies, and opt for higher deductibles.

For personalized conversation or quotes, contact a local State Farm agent.

How much car insurance do I need?

Liability insurance covers costs if you're at fault in a crash, including property damage (PD) and bodily injury (BI) to others. Most states require minimum coverage. Higher limits better protect your assets since you’re responsible for damages beyond your policy. Typical liability limits are shown as three numbers (e.g., 100/300/100): per-person BI, total BI per accident, and property damage limits (all in thousands).

Collision insurance covers your car’s repair after an accident; comprehensive covers non-collision damage like theft or weather. If you own your car outright, dropping these coverages may save money but risks you paying full repair/replacement costs. Consider your car’s value versus coverage cost and deductible when deciding.

Higher deductibles lower premiums but increase out-of-pocket costs. Choose a deductible you can afford in a loss. A 2000 dollar collision deductible saves money on premium, but if an accident occurs the insured will have to pay 2000 dollars for that coverage.

Other coverages to consider:

- Uninsured/Underinsured Motorist: covers damages from drivers without adequate insurance.

- Medical Payments/Personal Injury Protection: pays medical and related expenses regardless of fault.

- Emergency Road Service: covers roadside help like towing and tire changes. Optional extras include rental reimbursement and ridesharing coverage.

Can someone else drive my car?

Sometimes you might want to let someone else use your car, but you may wonder if it's okay or if your insurance will cover them.

Here are some common questions:

- Can my babysitter drive my kids in my car?

- Can my friend or family member borrow my car?

- Can I drive someone else’s car?

- Will my friend’s insurance pay if I damage their car?

- Do occasional drivers need to be added to my insurance?

The short answer:

You may provide permission to someone with a valid driver’s license to drive your car occasionally. However, those who drive your vehicle regularly should be reported as drivers on the policy. Check with your insurance agent if you’re unsure.

Whose insurance pays if there's damage

Usually, your insurance pays first if the person driving your car causes an accident. Their insurance might help pay medical bills or cover excess costs if your limits aren’t enough.

What should I think about before letting someone drive my car?

- Make sure the driver has a valid license.

- Don’t lend your car to someone with a bad driving record (like many accidents or DUIs) because you could be responsible if they cause a crash.

- If someone will drive your car (like a nanny or roommate), add them to your insurance policy.

How do I know what is covered?

Insurance rules can be different depending on your state and policy. Talk to your insurance agent before letting someone else drive your car or other vehicles like motorcycles, boats, or ATVs.

Use common sense and be careful. Lending your car is a big responsibility and could affect your insurance.

What questions should I ask my agent?

Why should I meet with my insurance agent?

Regular check-ins help review your coverage for life changes like income boosts or family growth. If you can’t meet in person, connect via app or email.

Where can I find my insurance information and coverage details?

Your can find your coverage information on the Declarations document sent to you by your insurance company or your Mobile App. ID cards are also sent to provide the legally required proof of insurance, however they don’t usually provide specific coverage details.

Can I bundle policies and get a discount?

Yes, bundling auto and homeowner’s policies often earns discounts. Safe driving may also qualify you for savings. Ask your agent for details.

How do claims work?

Insurers will reimburse for losses incurred as a result of an accident subject to the policy provisions.

Where can I learn more about insurance and finances?

Talk to your agent or explore resources like Simple Insights and apps such as Drive Safe & Save® for tips on driving and savings.

Can I make changes to my insurance policy?

Yes, changes can be made anytime due to budget shifts, moving, family changes, or buying a home. Your agent can help adjust coverage.

What does my auto policy cover?

Coverage requirements vary by state and by financing institutions (if a loan or lease is on the vehicle). Most states require Liability Coverages and Uninsured/Underinsured Motorist Coverages. Optional coverages include Medical Payments Coverage, Collision, Comprehensive, and Emergency Road Service.

What should I do if I get in a car accident?

Ensure safety, call the police, exchange insurance info using your ID card, and notify your agent promptly.

How much renters insurance should I buy?

Renters insurance protects your personal belongings and provides liability coverage, which landlord insurance doesn’t cover. It’s affordable—around $15/month for $35,000 in property coverage—and often required by landlords.

To determine how much coverage you need:

- Inventory your possessions with details and photos.

- Choose a deductible you can afford; higher deductibles lower premiums but increase out-of-pocket costs.

- Typical liability coverage is $100,000, but increase it if you have significant assets or frequently host guests.

- Be aware some perils (e.g., earthquakes, floods) and valuables have limited or no coverage; consider additional policies if needed.

Rates vary by location and property safety; having fire detectors or extinguishers may lower costs. Ask your agent about discounts, especially for bundling with other policies.

Transcript: Stop livin' on a prayer. Get State Farm.

0:00 So you guys are just like State Farm, right?

0:03 Oh no, no, no. No, no, no.

0:08 We barely cover boats by the dock.

0:11 Why barely?

0:12 You get what you pay for.

0:13 [music] Our bike coverage leaves out a lot. I don't have a bike.

0:17 Can we just get some momentum on the song? Oh, I'm going.

0:20 [music] There's damage to your home on this block.

0:24 We won't make things right cuz filing a claim is tough.

0:29 Can't I just do it in an app or call an agent?

0:31 No luck. Here comes the best part.

0:35 [music] Whoa, we're halfway there.

0:39 Whoa oh, you're living on a prayer.

0:43 Should have gone with State Farm.

0:46 Need a lift?

0:47 Yep. Stop livin' on a prayer and get State Farm.

0:57 So you're not like State Farm, correct?

Transcript: Stop Livin' on a Prayer (Extended Cut) | State Farm Commercial

0:01 So you guys are just like State Farm, right?

0:03 Like State Farm?

0:06 [music] Oh, no, no, no. No, no, no.

0:10 We barely cover boats by the dock.

0:13 Why not?

0:14 Just cuz. [laughter] You get what you pay for.

0:18 Our bike coverage leaves out a lot.

0:21 Yeah. I don't have a bike.

0:23 That's not your bike? Is this not your house?

0:27 It's not my house.

0:29 So this is technically trespassing. This is illegal. Okay. Right. Right.

0:32 There's damage to your home on this block.

0:36 We won't make things right, cuz filing a claim is tough.

0:41 Can't I just do it in an app or call an agent?

0:44 No luck.

0:47 So forget what we told you. It ain't worth squat.

0:52 It doesn't make a difference if you're happy or not.

0:56 We got weak coverage.

0:58 That's freaking hot... my thumb!

1:01 Hey buddy, don't touch that spot.

1:04 Chorus!

1:05 Whoa, we're halfway there. Whoa, you're livin' on a prayer.

1:12 Take your plan. It's full of hot air.

1:17 Whoa, dang, this long hair!

1:23 We got to hold on, ready or not.

1:27 Oh, no. Here's the key change. We'll give it a shot!

1:32 Whoa, we're halfway there. Whoa, you're livin' on a prayer.

1:40 Nailed it!

1:44 Should have gone with State Farm.

1:47 Need a lift?

1:48 Yep!

1:50 Is that Jake from State Farm?

1:52 Stop living on a prayer and get State Farm.

1:55 State Farm is there.

1:59 Did we just lose a customer?

2:01 Well, she was singing "State Farm is there" at the top of her lungs, so I'm assuming so. Yeah.

Easy (:30) | State Farm Commercial

0:01 Okay. Your price is like State Farm, but is your coverage?

0:04 [music] Oh no, no, no. No, no, no.

0:06 How we do things might leave you shocked.

0:09 Our claims aren't done right. Our process is rough. It's tough.

0:15 Can I get help from an agent?

0:17 No luck.

0:19 Do it online?

0:20 No luck.

0:21 An app?

0:22 No luck.

0:23 Take my phone. It's easy. I swear.

0:25 Like a good neighbor, State Farm is there.

Forget (:30) | State Farm Commercial

0:01 Will you be there when I need help? Just

0:02 like State Farm.

0:08 Forget what we told you. It ain't worth

0:12 it

0:14 if you're happy or not.

0:16 You to live. [music] Stop living on a

0:17 prayer and get State Farm. Oh,

0:20 now we're prepared.

0:23 Oh,

0:24 save from [music] his day.