What is contractors insurance?

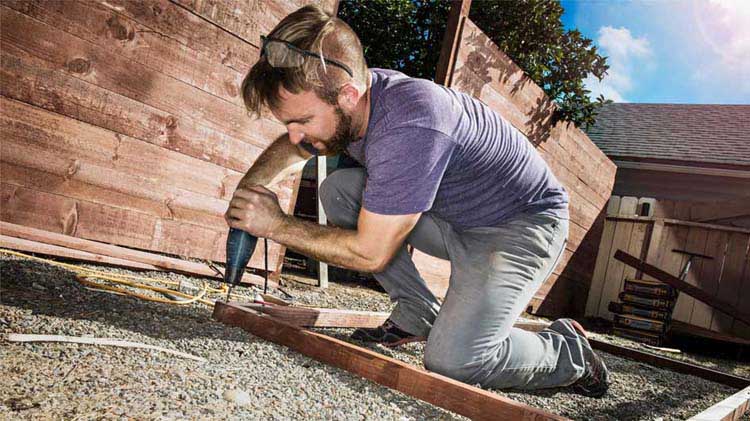

This insurance helps you safeguard your small businesses from financial losses due to accidents, injuries or damages related to your work or that of your employees.

Why consider adding contractors insurance coverage?

Getting contractor insurance may be key for your construction business to protect against financial losses and liabilities. It covers potential claims for injuries, property damage and mistakes, helping you bounce back from accidents and legal troubles.

State Farm Contractors Insurance may help protect against:

Damage to on-site property

If you accidentally burst a public water main while digging, contractors insurance may help cover the costs.

On-premise injuries

Leaving tools, like shovels and rakes, out can lead to trips and falls. Contractor insurance may help protect your landscaping business in these situations.

Theft

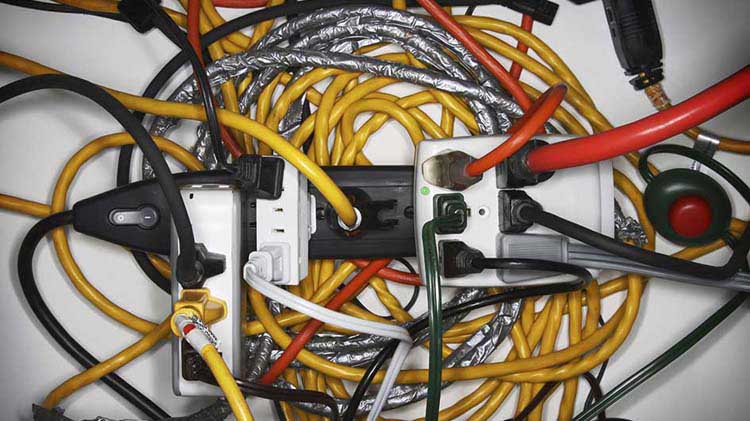

Tools are costly and may be hard to replace. If they go missing from a job site, contractors insurance may help ease the financial burden.

Help protect your equipment while on location

Your equipment and tools represent a major financial investment in your business. When you transport and use them on site, you want to ensure you can safeguard them from damage or loss. Mobile equipment coverage may help provide that protection.

What does contractors insurance cover?

This insurance helps provide a wide variety of coverages for professional contractors.

Business personal property

Helps protect your equipment from accidental direct physical loss

Building property

Covers your building, storage buildings, garages, fixtures and other structures

Liability

Helps insure you and your business against costly claims and lawsuits

Completed operations

May provide coverage for bodily injury and property damage claims resulting after construction or a project is completed

Property of others

Helps cover damage to someone else’s property while it is in your care, custody or control

Coverage in action

If your landscaping team trims a heavy tree branch that falls and damages your customer’s fence, contractors insurance may help cover the costs.

Installation floater coverage

Your HVAC business, for example, may require you to transport heavy equipment, such as a new furnace or air conditioner, to your customer’s home. Installation floater coverage may provide you with the protection necessary should things go awry.

Frequently asked questions about contractors insurance

The cost of contractors insurance may vary based on coverage type, business size, location and other factors. Contact your State Farm agent to discuss your specific needs.

Depending on the type of business and jurisdiction, you may be required to have insurance. For those not required, the coverage still provides for your property and liability needs and demonstrates to your customers you are a responsible business owner.

Workers' compensation is generally associated with the relationship between employers and employees; however, it can also extend to independent contractors. If you operate as a general contractor or a subcontractor, you might need to obtain workers' comp insurance if your contract stipulates it. It’s important for business owners to understand their state’s laws regarding employee-employer relationships and contractors.

Coverage for tools and equipment is an optional coverage selection on the contractors insurance product.

Get a local agent who gets you

There’s a State Farm agent nearby ready to offer personalized service to fit your specific needs.

Simple Insights®

Looking for ways to help keep your small business running smoothly? You’ve come to the right place. Articles from Simple Insights draw on over 100 years of State Farm knowledge.

Prices are based on rating plans that may vary by state. Coverage options are selected by the customer, and availability and eligibility may vary.

This is only a general description of coverages of the available types of business insurance and is not a statement of contract. Details of coverage, limits, or services may not be available for all business and vary in some states. All coverages are subject to the terms, provisions, exclusions, and conditions in the policy itself and in any endorsements. Contact a State Farm agent for more information and a customized quote.

State Farm (including State Farm Mutual Automobile Insurance Company and its subsidiaries and affiliates) is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third-party sites hyperlinked from this page. State Farm has no discretion to alter, update, or control the content on the hyperlinked, third-party site. Access to third-party sites is at the user's own risk, is being provided for informational purposes only and is not a solicitation to buy or sell any of the products which may be referenced on such third-party sites.

State Farm Mutual Automobile Insurance Company

State Farm Indemnity Company

State Farm Fire and Casualty Company

State Farm General Insurance Company

State Farm Life Insurance Company (Not licensed in MA, NY or WI)

State Farm Life and Accident Assurance Company (Licensed in NY and WI)

Bloomington, IL

State Farm County Mutual Insurance Company of Texas

State Farm Lloyds

Richardson, TX

State Farm Fire and Casualty Company

Tallahassee, FL