Articles to help maximize your budget

How to spend money wisely and have fun with your friends

Maximize fun with friends and stick to your budget. It's all about planning in advance for spending money wisely.

Budget breakdown

You can have a budget — and still live the life you want to live. Budgeting is a simple and reliable resource for shedding unwanted debt, reaching financial goals, living a healthier financial lifestyle and maintaining true financial wellness.

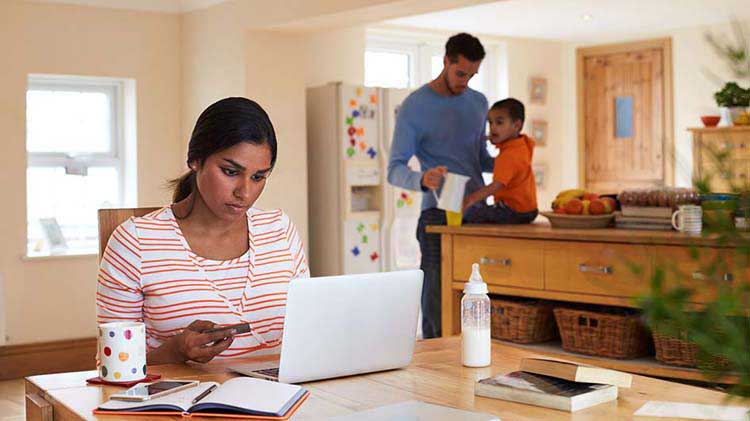

The dual income advantage: Money management for couples

Managing money together can help couples make decisions that can benefit their financial future. Connect with your significant other and get started on some practical money management methods today.

Tips to help increase your savings

How To Build Credit

Understand how credit works and learn ways to build and improve your credit score.

Build an emergency fund

Having extra cash in an emergency fund comes in handy when life throws you something unexpected.

How to budget for non-monthly expenses

Everyone runs into irregular or non-monthly expenses throughout the year. Find out more about budgeting and managing them.

Additional budgeting articles

How to get out of debt

Learn about debt management from reduction strategies to credit card debt consolidation programs to help find the right option for you.

How to use the 50/30/20 budget rule

Balance your personal spending and saving with the 50/30/20 budget rule.

Know your company benefits to get all the perks

It pays to get in on all the benefits your employer offers.

Financial Goals by Age: A Decade-by-Decade Approach

Help take the guesswork out of your lifelong financial goals, including your retirement goals, short-term goals and other financial to-do’s at any age.

Organize paying bills

Habits of the financially savvy when dealing with paperwork.

Financial wellness tips to help improve your financial future

Get ahead and learn how to improve financial wellness through simple spending, saving and budgeting tips.

The psychology of spending money and why you may be spending so much

Trying to understand how you spend your money may help you build better financial habits and boost your savings.

Calculate spending and see the benefits of spending less

Determine how much those savings can accrue over the years.

How to avoid credit card interest

Learn about credit card interest and consider these tips on ways to help avoid, reduce and manage it when using a credit card.

Holiday budget and saving tips

By using these holiday budgeting tips and saving strategies, you can help make your holidays joyful, memorable and affordable, without overspending.

The information in this article was obtained from various sources not associated with State Farm® (including State Farm Mutual Automobile Insurance Company and its subsidiaries and affiliates). While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.