How much does pet insurance cost? What to consider before buying

Pet health insurance providers like Trupanion can help pet owners manage unexpected and costly veterinary fees, but how much does pet insurance cost? Is pet insurance worth it?

Are you shopping for more affordable pet insurance? Choosing a cheaper pet insurance plan may come at its own cost to your pet’s care. To help make an informed decision for you and your pet, it’s important to understand how much quality pet insurance costs, and what options may be available to help you pay for your pet’s veterinary care long term.

Is pet insurance worth it?

It’s no secret that modern veterinary care can quickly get expensive — especially when emergency care is needed, or a pet gets diagnosed with a chronic illness. Sadly, many pet owners might not have enough money set aside in their savings account to help pay for these unexpected vet bills, and some pet owners have to forego veterinary care due to the cost. Trupanion conducted a survey of Veterinary Professionals in 2023 that indicated that if a veterinary bill exceeded $1,145, the average pet owner would not be able to afford to proceed with the treatment.

Even if you save money every month instead of paying pet insurance premiums, it’s hard to predict when an emergency may happen. It could take years to save a few thousand dollars, but your pet may end up needing emergency treatment before you have the funds set aside to help pay for it. In some cases, it may be impossible to save enough money for life-saving treatment — the highest claim that Trupanion paid directly to a veterinarian in 2024 was $76,974.21!footnote 1

Purchasing a Trupanion insurance policy through your local State Farm agent can help by covering up to 90% of eligible veterinary expenses. However, how will paying for pet insurance affect your monthly budget?

How much does pet insurance cost?

According to NAPHIA, the average monthly cost of pet insurance is continuing to rise as the cost of veterinary care rises, and can be impacted by a variety of factors. A more reliable way to find out how much pet insurance costs is to run a quote for your pet.

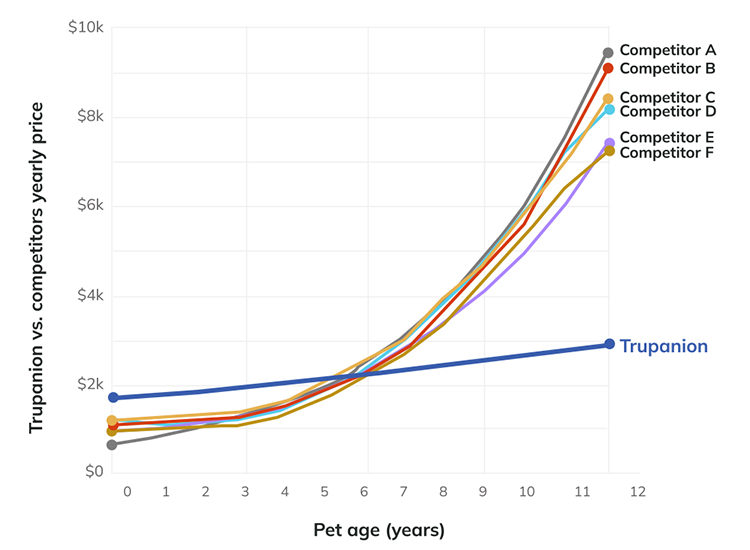

Coverage for dogs and cats that helps pay for a high percentage of unexpected veterinary bills with no payout limits will likely come at a higher cost. Some pet insurance providers may offer lower initial rates, but fees may increase every year after your pet has a birthday, or even after you’ve had to use your pet’s coverage, which may affect pet insurance affordability over time. What may seem like an inexpensive dog or cat insurance plan at first could end up costing you more than anticipated in the long run.

Trupanion is unique because Trupanion prices your pet insurance policy based on the expected lifetime care of your pet, only adjusting their rates over time in response to rising costs of veterinary care. This means that if you sign your puppy or kitten up with Trupanion, you will pay the “puppy rate” for as long as you keep your insurance policy. While this often means that Trupanion charges more than other pet insurance providers when you first enroll, the goal is to help you continue to be able to budget for your pet’s health insurance policy well into your pet’s senior years, when you are more likely going to need to use your insurance. Below is an illustrative example of how this could look:

The example above is based on a Labrador puppy in California, where we compared Trupanion's lifetime cost with 6 major competitors. The information was pulled from public filings as of March 1, 2025 and includes assumptions based on annual inflation.

Factors that can affect pet insurance rates

The cost of pet insurance is generally calculated using several factors:

- Species — dogs are typically more expensive to insure than cats.

- Breed — different breeds are more susceptible to certain health conditions and risks. For example, 60% of Golden Retrievers will receive a cancer diagnosis in their lifetime.

- Age — older pets generally come with higher health risks, resulting in higher rates. This is why it can be beneficial to help protect your pet while they’re young. Trupanion is unique because they use your pet’s age at enrollment to help price your policy, whereas many other pet insurance providers will use your pet’s attained age.

- Gender — some pet insurance providers use your pet’s gender as a pricing factor.

- Location — areas that have higher costs of living may come with higher pet insurance rates, due to veterinary operational costs.

- Deductible — a low deductible will generally result in a higher monthly premium, whereas a high deductible may result in a lower monthly premium.

- Your coverage options — some providers allow you to choose your payout percentage, choose your annual limit, or they may offer additional coverage packages.

There is no simple answer to how much pet insurance will cost for your pet — a generally dependable approach is to get a quote.

Why does my pet’s breed impact my pet insurance pricing?

Regardless of species, different breeds of cats and dogs come with genetic traits that can cause expensive medical issues. Some features that make breeds unique, like the flat noses of French Bulldogs and Persian Cats, can cause chronic medical conditions that require regular treatment or even surgery to correct. Larger animals like Great Danes are more susceptible to joint problems and arthritis as they age, and some breeds are naturally high-energy, leading them to have higher-than-normal injury rates.

For pet insurance providers to help support veterinary care needed throughout your pet’s lifetime, they need to be able to accurately estimate the risk factors associated with your pet’s breed. Choosing a pet insurance provider that offers coverage for hereditary conditions may help you avoid an expensive surprise if you own a purebred cat or dog.

Other factors that can impact pet insurance affordability

In addition to your personal details and those of your pet, it’s important to look closely at a pet medical insurance provider’s fine print and consider the coverage options available to you. A cheaper pet insurance rate may end up costing you more than you expect over the long run. Here are some key things to consider:

Payout limits

Many pet insurers limit how much they will pay out for your pet’s coverage. This can be a total payout limit per pet, per year or per condition. Trupanion, however, does not have payout limits — you never know when your veterinary bill could climb into the tens of thousands of dollars! Trupanion processed 2,310 claims that cost over $10,000 in 2024.footnote 1

Deductibles

A pet insurance deductible is the amount you pay out-of-pocket before your pet insurance plan takes over. Pet insurance providers may approach deductibles differently, and it’s important to understand how a deductible operates before you sign up for a pet insurance policy.

Selecting a high deductible can help reduce your monthly premiums because you will have to pay more of the veterinary invoice before your coverage kicks in. Many pet insurance providers have restrictions around lowering your deductible after you enroll, so select a deductible that you will be comfortable paying in case something happens to your pet.

Many pet health insurance providers have an annual deductible that resets every year, which is similar to how a deductible with human health insurance works. Trupanion’s insurance is unique because they have a per condition, lifetime deductible. Pets will typically have less conditions over their life than years of life. For example, the average Trupanion customer typically pays three deductibles over a 12-year period, compared to an estimated 12 deductibles with some other providers.footnote 2

What’s covered

Obtaining pet medical insurance can help provide financial support if your pet becomes sick or injured in the future. It can be helpful to review what is and isn’t going to be covered before you sign up. While a cheaper pet insurance plan might be tempting at first, it may offer more limited coverage for certain health conditions or veterinary treatments that a more comprehensive policy may cover.

Meanwhile, pet health insurance that is designed for the life of your pet can help cover a high percentage of the cost of diagnosing and treating any new, unexpected accident or illness. For some providers, this quality coverage can mean high payout limits. But with a Trupanion plan, there are no payout limits.

Some pet insurance providers offer a wellness plan for an additional monthly cost. If you are looking to get coverage for routine expenses for your pet, consider reviewing the details of what services are covered by the wellness plan, and compare the benefits against what you are being charged for the wellness plan every year. Some providers may charge more for the wellness add-on than you can realistically make use of in a year. Many veterinarians offer a wellness plan that functions like a loyalty discount, so if you are looking for a way to help budget for your pet’s annual visit, ask your veterinarian if they have any recommendations for you and your pet.

Comparing pet insurance costs

Because pet insurance isn’t one-size-fits-all, consider consulting with your veterinarian about your pet’s health history and breed-specific risks. When you are ready, your local State Farm agent can help you explore pet insurance options that fit into your monthly budget.

Remember, an effective pet insurance policy is one that helps you provide outstanding care without compromising your financial well-being.