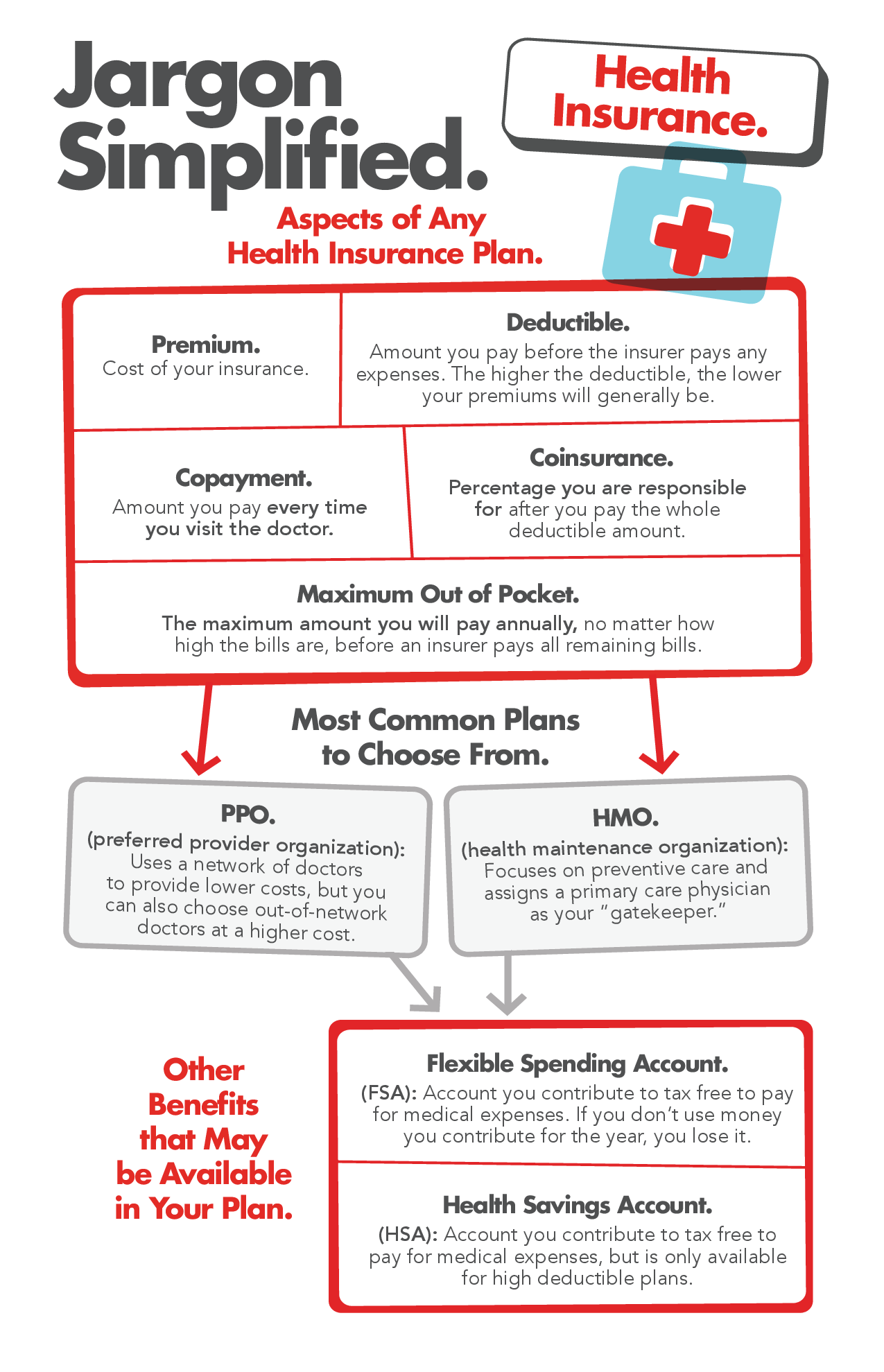

Health insurance terms

Understanding important health insurance jargon can help you navigate insurance with confidence.

Insurance is complicated to begin with, but health insurance can feel especially complex. Whether you're in the market for health insurance, or find yourself having to use it, knowing the basics of how health insurance works can help to understand what you've got to pay, and why.

It's no secret that healthcare can be expensive. On top of that, your monthly health insurance costs can vary depending on the type of plan you choose. The health insurance simplified infographic can help shed some light on common key words and phrases to understand as you choose the healthcare plan that's best for you, or better understand the coverage you already have.

Health insurance enrollment

Open enrollment for many major medical plans is typically November through December. If you have a qualifying life event happen (like getting married or moving) you can make adjustments outside of the designated enrollment period.

To get ahead of the game, take a look at your current healthcare plan to make sure you're confident with your coverage and understand your plan. And, check out www.healthcare.gov for even more specific healthcare plan information.

Here are common health insurance terms and what they mean:

Health insurance premium

Cost of your health insurance, typically paid on a monthly basis.

Health insurance deductible

Amount you pay before the insurer pays any expenses. The higher the deductible, the lower your premiums will generally be.

Health insurance coinsurance

Percentage or amount you are responsible for after you pay the whole deductible amount.

Health insurance copay

The health insurance copayment is sometimes due to your provider each time to visit, other times it will be billed after the visit.

Maximum Out of Pocket

The maximum amount you will pay annually, no matter how high the bills are, before an insurer pays all remaining eligible bills.

These are the most common plans to choose from:

PPO

PPO insurance uses a network of doctors to provide lower costs, but you can also use out-of-network doctors, potentially at a higher cost.

HMO (health maintenance organization)

HMO insurance focuses on preventative care and assigns a primary care physician as your "gatekeeper".

Other benefits that may be available in your plan:

Flexible Spending Account (FSA)

Account you contribute to tax free to help pay for eligible medical expenses. If you don't use money you contribute for the year, you may lose it.

Health Savings Account (HSA)

Account you contribute to tax free to pay for medical expenses, but is only available when you have a high deductible medical plan.