Whole Life insurance

Read about the difference between Ordinary and Limited-payment life as well as uses for Whole Life insurance.

What is Whole Life insurance?

Whole Life Insurance, sometimes called permanent insurance, or ordinary life, is designed to stay in force throughout one's lifetime. As long as the policy owner meets his or her obligations under the policy, the policy remains in force, regardless of any changes in health that may occur.

Premiums for most whole life policies remain level. A portion of each premium payment is set aside to earn interest. Over time, a whole life policy will develop cash values. The accumulated cash values form a reserve which enables the insurer to pay a policy's full death benefit, while keeping premiums level.

During life, many whole life policies have provisions to borrow a portion of the accumulated cash value. If a policy is terminated without the insured dying, there are various surrender options for the cash value available to a policy owner.

Policy variations

There are two primary types of whole life insurance, based on the period over which the premium payments are made:

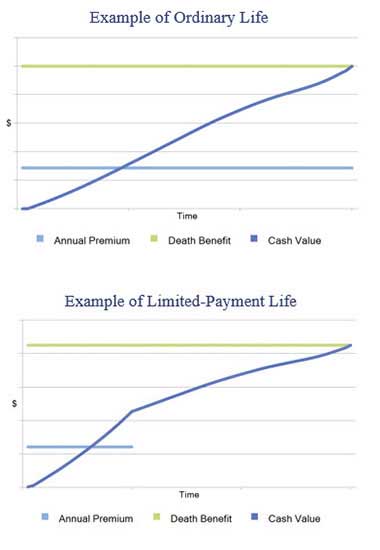

Ordinary life: An ordinary life policy assumes that premiums will be paid until the insured dies. Premiums are based on the assumption that the insured will die at a certain age, typically age 100. If an insured lives to this age, the policy pays the face amount of the death benefit.

Limited-payment life: This type of whole life policy assumes that all premium payments are made over a specified, limited period, typically ranging from one to 30 years. Premiums for a limited-payment life policy are generally higher than for an ordinary life policy, because the payment period is shorter.

Common uses of Whole Life insurance

Whole life policies are well suited for needs that do not diminish over time. Some commonly found uses for whole life are:

- Family protection: To provide funds to support a surviving spouse and/or minor children, particularly for individuals who start a family later in life; to pay final bills, such as medical or other estate expenses, and federal and state death taxes.

- Business planning: Whole life insurance is often used for many different business purposes, such as insuring key employees, in split-dollar insurance arrangements, and funding nonqualified deferred compensation plans. Business continuation planning often involves using whole life insurance as a source of funds for buy-sell agreements.

- Accumulation needs: Some individuals will use the cash value feature of whole life as a way of accumulating funds for specific purposes, such as funding college education, or as a supplemental source of retirement income.

- Charitable gifts: To provide funds for a gift to charity.

Modified endowment contracts (MECs)

A life insurance policy issued on or after June 21, 19881 may be classified as a modified endowment contract (MEC) if the cumulative premiums paid during the first seven years (7-pay test) at any time exceed the total of the net level premiums for the same period.

If a policy is classified as a MEC, all withdrawals (including loans) will be taxed as current income, until all of the policy earnings have been taxed. There is an additional 10% penalty tax if the owner is under age 59½ at the time of withdrawal, unless the payments are due to disability or are annuity type payments.

A whole life policy can avoid treatment as a MEC through a well-designed premium payment schedule.

Additional policy elements

Whole life policies often have additional, useful features:

- Policy loans: Almost all whole policies permit the policy owner to borrow a portion of the accumulated cash value, with the insurance company charging interest on the loan. The rate charged to borrow the funds is often lower than current open market rates. A policy loan will reduce the death benefit payable if the insured dies before the loan and any interest due is repaid. A policy loan will also reduce the cash surrender value if a policy is terminated. If a policy lapses or is surrendered with a loan outstanding, the loan will be treated as taxable income for the current year, to the extent of gain in the policy.

- Policy dividends: Whole life contracts classified as "participating" offer the possibility of policy "dividends." Such policy dividends are not guaranteed, and represent a return to the policy owner of part of the premium paid. A dividend may be taken as cash or a policy may offer a number of other ways the dividend might be used:

- To reduce current premium payments;

- To buy additional, completely paid-up insurance (known as paid-up additions);

- To be retained by the insurer, earning interest for the policyholder;

- To purchase one-year term insurance;

- To be added to the policy's cash value;

- To "pay up"the policy earlier than originally scheduled.

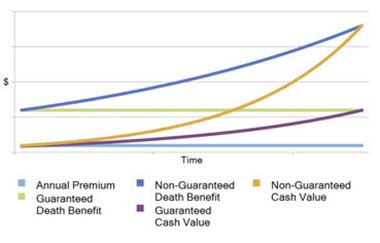

Policy dividends used to purchase paid-up additions

Although policy dividends are not guaranteed, using available dividends to purchase paid-up additions can, over time, have a significant, positive impact on both the death benefit and cash value of a whole life policy. The diagram illustrates how this might work, in a hypothetical life insurance policy.

Optional policy provisions

A number of optional provisions, commonly referred to as riders, can be added to a basic whole life policy, generally through payment of an additional premium:

- Waiver of premium: Waives the payment of policy premiums if the insured becomes disabled and unable to work.

- Accidental death: Pays the beneficiaries double (in some situations triple) the face amount of the policy if the insured dies in an accident.

- Spousal or family term insurance: Allows a policy owner to purchase term insurance on a spouse or children.

- Accelerated death benefits: An accelerated death benefits provision allows for payment of part of a policy's death benefit while an insured is still alive. Such benefits are typically payable when the insured develops a medical condition expected to lead to death within a short period of time.

1 Including a policy issued before that date, but later materially changed.