Is bundling insurance worth it?

Typically, yes. Bundling insurance policies may stack discounts and simplify policy management, saving you money and time.

What is HO-6 insurance?

Condo insurance coverage works along with the condo association master insurance policy. Learn how they work together to help protect you and your stuff.

Pros and cons of buying a condo

Consider the benefits and drawbacks of purchasing a condominium as you evaluate the right home for you.

Additional articles for condo owners

How to create a home inventory

A home inventory can help expedite the insurance claims process after theft, damage or loss.

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions and insurance for storage.

Insurance issues to consider when hosting a house party

Hosting a party? Put insurance on the invite list and help make sure your home is covered.

Under sink storage: What not to store under the sink

Organize the space under the sink to make your home safer and more efficient. Read these helpful ideas that are easy for everyone in your household to follow.

Help protect your home and family with home security

Learn how the different types of home alarm systems can help improve your home security and maybe even get you a discount on your homeowners insurance.

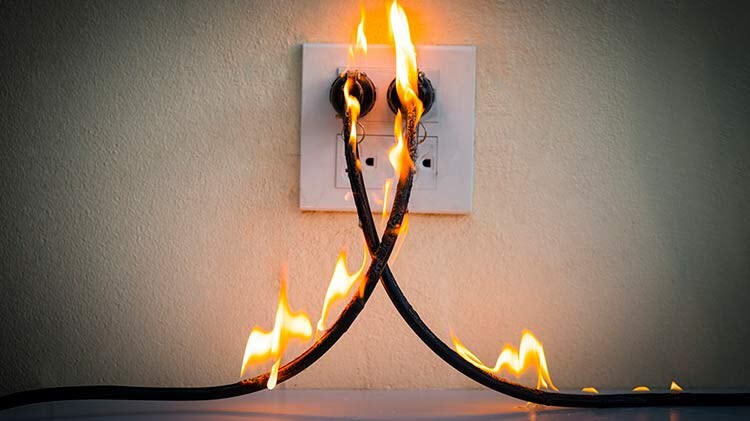

Be aware of electrical hazards in your home

What are some different residential electrical hazards?

Tips to help prevent burglary

Consider these home burglary prevention ideas to help protect your home.

Does your insurance provide coverage for home repairs?

Upkeep is a typical part of homeownership, but are there times that insurance could be used?

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Avoid some common grilling dangers.

Tips to deal with most common home emergencies

You may not be able to predict when a home emergency will occur, but you can be more prepared with a home emergency plan.

Help control your home monitoring system with your smartphone

The latest generation of remote home monitoring goes far beyond smoke detection and intrusion alerts. Multiple professional and do-it-yourself options are available to help make your home a smart home.

Can a power surge damage my electronics?

An invisible culprit may be harming your devices. Learn how to help protect your property.

Help conquer home humidity problems with these tips

High humidity is not only uncomfortable, it can also threaten your home’s structure and surfaces.

Protecting your home while on vacation

Consider these tips to help with home security and protection when you are away.

The information in this article was obtained from various sources not associated with State Farm® (including State Farm Mutual Automobile Insurance Company and its subsidiaries and affiliates). While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.