Does your insurance provide coverage for home repairs?

Upkeep is a typical part of homeownership, but are there times that insurance could be used?

Homeownership can be exciting, but many homeowners will likely experience the need for home repairs and maintenance at some point. Whether it’s from a leaking roof, broken furnace or HVAC system issue, the cost for repairs can quickly add up. It’s important to know what your homeowners insurance might cover when the unexpected happens.

When could insurance apply for home repairs?

Homeowners insurance isn't used for your typical household maintenance. Instead, it's there for unforeseen or accidental damages. Below are a few examples where homeowner's insurance could apply for covered losses:

- Fire or smoke — if your kitchen sustains damage due to a fire.

- Hail damage — if your roof or home sustains damage from a hailstorm.

- Windstorm — if there's a storm and a tree limb or other debris causes damage to your home.

- Frozen pipes — winter weather sometimes results in frozen pipes that can burst. This can cause water damage and the need for plumbing repairs.

If you have doubts whether a repair could potentially be covered by your insurance, discuss with your insurance agent.

What do home warranty plans typically cover?

Home warranty plans, sometimes referred to as home repair insurance, typically cover:

- Appliances

- Electrical systems

- Plumbing

- Air conditioning

- Furnaces

What is considered home maintenance?

Homeowners insurance typically does not provide coverage for damages due to lack of maintenance from wear and tear. For example, if you have a roof that has been deteriorating throughout the years and your roof starts to leak, the roof repair would most likely not be covered. This is why regular home repairs and maintenance of your residence is important.

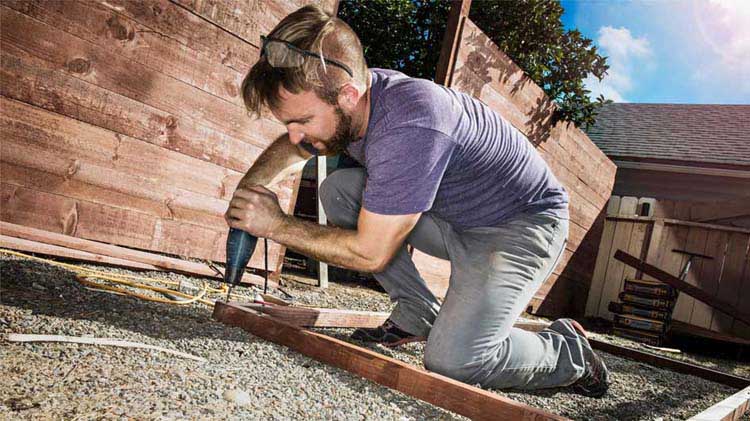

Whether its painting, caulking or cleaning gutters, maintaining a home can be a lot of work. You can tackle some projects yourself, but others might require a professional. Do your research to help you make that decision. Remember to document any maintenance or repairs you’ve made. This could be beneficial if you find yourself navigating the claim process.

The following are examples of home maintenance:

- Replacing doorknobs

- Repainting walls

- Changing the carpet

- Cleaning gutters

- Maintaining the washing machine

- Cleaning the dryer vent

- Caulking windows

- Staining decks

- Sweeping the chimney

- Maintaining the garage door

- Cleaning the septic tank

- Replacing a sump pump

- Cleaning furnace filters, air ducts and vents

As large appliances and home systems get older or wear out, it's not unusual to replace them. These items may include:

- Refrigerator

- Dishwasher

- Stove/cooktop/oven

- Air conditioner

- Furnace

- Water heater

Worn out or obsolete appliances are typically not covered by insurance. However, you can contact your local State Farm® agent for information on Home Systems Protection which may offer insurance protection for certain perils typically not covered by a homeowners policy.

The information in this article was obtained from various sources not associated with State Farm® (including State Farm Mutual Automobile Insurance Company and its subsidiaries and affiliates). While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.

This article was drafted with the help of AI and reviewed by State Farm editors.

State Farm Fire and Casualty Company

State Farm General Insurance Company

Bloomington, IL

State Farm Florida Insurance Company

Tallahassee, FL

State Farm Lloyds

Richardson, TX