What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

No matter how prepared you are, it can be difficult to know what to do after a house fire. These tips may help you get back on your feet:

Take care of yourself and your family

- Find a safe place to stay — depending on the extent of the damage, you may not be able to stay in your home. If staying with friends or family isn't an option, contact a local disaster relief agency, such as the American Red Cross or the Salvation Army. These organizations can help you find temporary accommodation. Additionally, if your home is uninhabitable due to a covered fire, your homeowners or renters insurance policy may provide financial assistance for temporary lodging and other living expenses.

- Take care of your pets — consider getting your pets checked by a veterinarian after a fire. Your pets' lungs may be damaged by smoke and burns can hide under fur. If you have pet insurance, contact your insurance company.

- Consider your family's mental health — disasters can make it difficult to cope, and this is particularly true of children. Be patient with yourself and your family as you work through any stress caused by the fire. If your family is having difficulty coping, seek support.

Who to contact after a house fire

- Contact your insurance agent. You'll need to start a claim and address your immediate needs. Your insurance agent should also be able to help you secure your property and offer recommendations for cleaning up or restoring salvageable items.

- If you rent, call your landlord. Notify your landlord about the house fire if they aren’t already aware. There may be actions they need to take to help address the damage.

- Let your family and friends know you’re safe. As word gets out that you’ve had a house fire, family, friends and neighbors may be concerned. Try to reach out to them when you have time.

What to document after a house fire

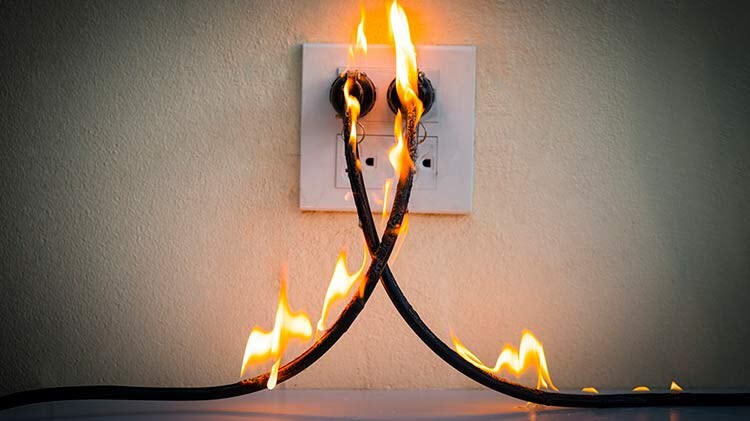

- Get a copy of the fire report — a fire report shares the circumstances of your house fire, such as a wildfire, gas fire or other common causes of house fires. You can usually get fire reports from your local fire department. The report may be helpful in providing information for your insurance provider.

- Take pictures — when it is safe to do so, take pictures of your damaged property. This can help you document what needs to be replaced before it is possibly damaged further or removed from your home.

- Address your finances — even if your home is destroyed, keep a record of any continued mortgage or car payments. You may also need to replace any credit or debit cards that may have been destroyed in the house fire.

Creating a home inventory checklist

It can be overwhelming to know what to do after a fire in your house, especially when making an insurance claim. However, having a prepared home inventory checklist on hand can help you identify which personal items have been lost or damaged in the event of a fire. This checklist is a detailed list of everything you own, including furniture, electronics, clothing, jewelry, appliances and any other personal items in your home.

When listing items on your home inventory checklist, include photos, purchase dates, serial numbers and receipts if you have them. The more thorough your home inventory checklist, the easier it will be to identify personal property items lost or damaged in a fire.

Handling damaged property after a house fire

After a fire, many items in your home may be affected by smoke, heat or firefighting chemicals, even if they aren’t visibly burned. This could include furniture, clothing, food, medicine, cosmetics and items made of plastic that may have absorbed toxic fumes.

Before throwing anything away, it’s important to contact your insurance company. Your policy likely requires you to let the insurer inspect damaged property before it’s disposed of or replaced. Take note of all damaged items in your personal property loss inventory and, if possible take photos for your records.

Your insurance company may send an adjuster to evaluate which items can be cleaned and which need to be replaced. They can guide you on what to do next. Disposing of items too soon could affect your claim or coverage, so always check with your insurer first.

Working with your insurance company

To get back on your feet, it’s important to contact your insurance company. If needed, your insurance agent may issue an advance from your insurance policy to cover living and other daily expenses. If you receive an advance on your claim, save all receipts and keep a detailed record of all purchases.

When completing a personal property inventory of items lost or damaged in the fire, be honest and as thorough as possible and provide any documentation you can find. If you don’t already have a prepared home inventory checklist, work room by room to remember your possessions and ask family members to help recalling items.

Contact your insurance representative and they can guide you through the process. Many insurance companies offer online aids or personal property inventory tools to help you document the loss and to keep your inventory updated moving forward.

The information in this article was obtained from various sources not associated with State Farm® (including State Farm Mutual Automobile Insurance Company and its subsidiaries and affiliates). While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third-party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.

This article was drafted with the help of AI and reviewed by State Farm editors.

State Farm Fire and Casualty Company

State Farm General Insurance Company

Bloomington, IL

State Farm Florida Insurance Company

Tallahassee, FL

State Farm Lloyds

Richardson, TX