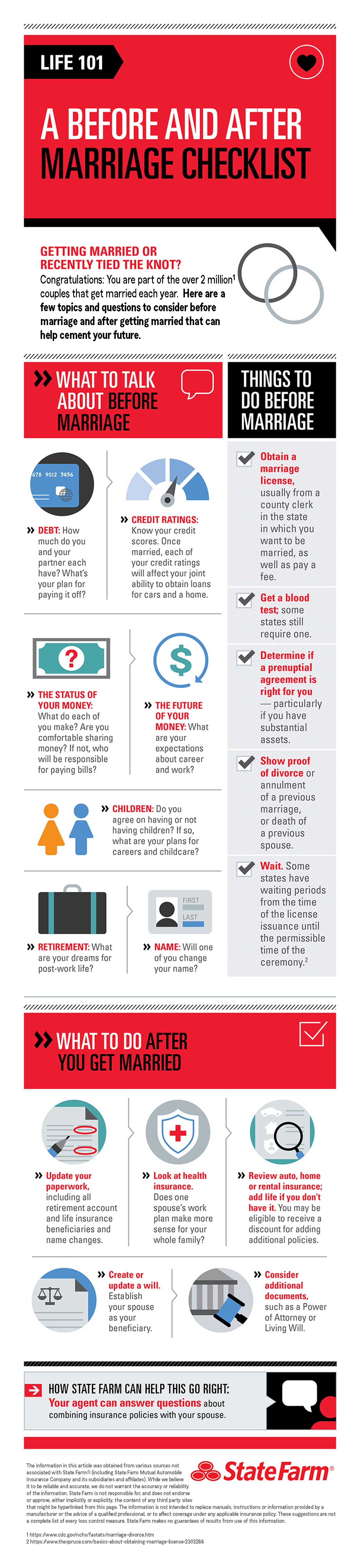

A before and after marriage checklist

Getting married or recently tied the knot?

Left side white content to render image on the right

You are part of the over 2 million couples that get married each year. Here are a few topics and questions to consider before marriage and after getting married that can help cement your future.

- Debt. How much debt do you and your partner each have? What's your plan for paying off debt?

- Credit ratings. It's always good to know your credit score and what a good credit score is. Once married, each of your credit ratings will affect your joint ability to obtain loans for cars and a home. If one of you has a lower score than desired, we have help to improve your credit score.

- The status of your money. What do each of you make? Are you comfortable sharing money? If not, who will be responsible for paying bills?

- The future of your money. What are your expectations about career and work?

- Savings. How much will you have for savings? Experts suggest saving three to six months of expenses in an emergency fund.

- Children. Do you agree on having or not having children? If so, what are your plans for careers and childcare?

- Retirement. What are your dreams for post-work life? What type of retirement plan works for you?

- Name. Will one of you change your name?

Things to do before marriage

- Obtain a marriage license, usually from a county clerk in the state in which you want to be married, as well as pay a fee. Depending on your state, the marriage license may be good for 30 days or up to a year, it's a good Idea to verify.

- Get a blood test if required by your state.

- Determine if a prenuptial agreement is right for you particularly if one or both of you have substantial assets.

- Show proof of divorce or annulment of a previous marriage, or death of a previous spouse.

- Wait. Some states have waiting periods from the time of the license issuance until the permissible time of the ceremony.

Must-dos after you say "I do"

- Update identification, including driver's license, Social Security card and notify places that have your pre-marital information on file.

- Update your paperwork, including all retirement account and life insurance beneficiaries and name changes.

- Look at health insurance. Does one spouse's work plan make more sense for your whole family?

- Look at insurance such as auto, home or rental insurance; add life insurance if you don't have it. You may be eligible to receive a discount for adding additional policies.

- Create or update a will. Establish your spouse as your beneficiary.

- Consider additional documents, such as a Power of Attorney or living will.

Your State Farm® agent can help you navigate the changes and help with your insurance planning needs.