The importance of comprehensive coverage: Protecting your vehicle

From unpredictable weather events to theft and vandalism, your car might face various threats beyond just accidents on the road. Learn why comprehensive auto insurance coverage is important when helping protect your vehicle.

Overview: Comprehensive coverage helps protect your vehicle from damages caused by events other than collisions. This can include theft, vandalism, weather-related incidents, falling objects and glass damage. Comprehensive coverage is important because it can help you manage high costs from unpredictable incidents. There are many ways to assess whether comprehensive coverage is right for you: review your current policy, talk to an insurance agent or shop online to evaluate plans that help fit your needs.

Unlike collision coverage, comprehensive coverage applies when your vehicle is damaged by non-collision events. It can act as a safety net for you and your finances when your vehicle is damaged by natural events, fire or vandalism. Because of this, it is important to understand how comprehensive coverage might benefit you and what it may cover.

Why is comprehensive coverage important?

Comprehensive coverage is important for drivers who want to help safeguard against life’s uncertainties. It is a protective measure to help ensure you’re not left vulnerable in unforeseen situations.

Comprehensive coverage may help you:

- Avoid big bills — it can help provide important protection for your budget against large, unexpected expenses.

- Fulfill lender requirements — with car loans and leases, the bank or finance company often requires comprehensive coverage to protect their investment until the car is paid off.

- Maintain control — with comprehensive coverage, you often choose how high (or low) your deductible will be. You get to find the balance that feels right for your budget.

Why might I need comprehensive coverage?

How do you decide if it's right for you? Consider the following:

- Potential cost of repairs — even small repairs, such as windshield replacement, can be costly — and major repairs or replacement of your vehicle can be even more expensive. The actual cash value (ACV) of the vehicle is also important to consider.

- Your budget — could your budget comfortably afford a major repair bill or the cost to replace your car if it was damaged, stolen or destroyed? Unforeseen incidents may be expensive and hard to financially recover from.

- Risk factors — if you do not have access to secure parking, the risk of loss due to theft, vandalism or severe weather is greater and protection may be beneficial.

What comprehensive may cover

Comprehensive coverage can help protect your vehicle from incidents such as:

Your vehicle gets stolen or damaged from a break-in.

Vandalism

Your vehicle is vandalized, such as being spray-painted or having tires slashed.

Weather

Hail damages the roof of your vehicle.

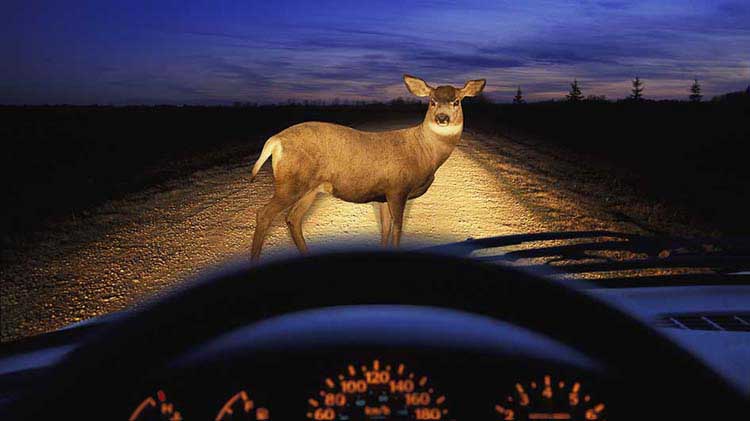

Hitting an animal

You hit a deer, and the front of your vehicle is damaged.

Falling objects

A large tree branch falls onto your parked vehicle.

A non-collision related fire damages your vehicle.

Cracked or shattered windshield or windows.

Next steps to obtain comprehensive coverage

Once you have decided that comprehensive coverage is right for you, there are actionable steps to take:

Check your auto insurance policy

When reviewing your insurance policy, look for details about comprehensive coverage and possible auto insurance discounts in the policy documents.

Note your deductible amount in your current policy. The deductible is the amount you pay out-of-pocket before your insurance kicks in. Deductibles can significantly impact the cost of the insurance policy. Choosing a higher deductible typically decreases your premium but it means you'll pay more when you make a claim, while opting for a lower deductible generally increases your premium but lowers your out-of-pocket expenses if an accident occurs.

Talk to your agent

Navigating insurance options can be tricky, so consider reaching out to your insurance agent. Agents can help answer questions about policies and complex terms. They can also help compare coverage options and help you choose coverage that meets your specific needs.

Discuss your vehicle’s value, your budget and any concerns about risks in your area. For instance, if you live in a region with frequent hailstorms, your agent might recommend comprehensive coverage for added protection.

Compare auto insurance quotes

If you’re shopping for a new policy or provider, focus on choosing appropriate coverage to best meet your needs and budget. Pay attention to differences in deductibles, premium costs and coverage limits when comparing quotes with various providers.

Plan ahead for better protection

Timing might be critical when adding comprehensive coverage to your auto insurance policy. Because of this, it’s wise to plan and buy comprehensive coverage well before you need it. By being proactive, you can help avoid gaps in coverage when disasters strike unexpectedly.

It’s important to make informed decisions about comprehensive coverage and your overall car insurance. You can get an auto insurance quote now, or give us a few details and a State Farm® agent will reach out to you.

The information in this article was obtained from various sources not associated with State Farm® (including State Farm Mutual Automobile Insurance Company and its subsidiaries and affiliates). While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third-party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.

Please remember that the preceding descriptions contain only a general description of available coverages and are not a statement of contract. All coverages are subject to all policy provisions and applicable endorsements. Coverage options may vary by state. To learn more about auto insurance coverage in your state, find a State Farm agent.

This article was drafted with the help of AI and reviewed by State Farm editors.

State Farm Mutual Automobile Insurance Company

State Farm Indemnity Company

Bloomington, IL

State Farm County Mutual Insurance Company of Texas

Richardson, TX