How to determine if supplemental health insurance is right for you

Supplemental health insurance helps pay for costs and services that your regular healthcare plan doesn't cover.

Healthcare costs can add up quickly and unpredictably due to an illness or injury. Regular health insurance policies do not necessarily cover all potential costs, including out-of-network charges, deductibles and copays, to name a few. In fact, a 2020 survey of insured American adults found that a third of respondents had received at least one unexpected medical bill in the previous two years.

Unanticipated medical costs can really stretch your monthly budget. Supplemental health insurance, also known as secondary health insurance, can help close those potential budget gaps.

What is supplemental health insurance?

Supplemental health insurance is an insurance policy that helps you pay unexpected medical bills that your regular health insurance plan doesn't cover. Here are some examples:

- Unexpected child care – pay for someone to take care of your children while you are ill or in the hospital;

- Pet care – keep your pets active even if your injury or illness makes it impossible to take them for walks yourself;

- Meals – if you are unable to cook, you could use part of your benefit to have food delivered to your home;

- Home maintenance – make sure the lawn gets mowed or the snow gets shoveled when you can't do it yourself;

- Transportation – pay for gas or even airfare and parking if you need to travel to see a specialist or make regular trips to a clinic;

- Deductibles and co-insurance amounts – help pay for deductibles not covered by your primary health insurance plan;

- Private room and private duty nurse fees;

- Outpatient surgery; and

- Emergency room visits.

Things to consider with supplemental health insurance

As you think about getting additional health insurance, begin by reviewing your current policies, including policies that cover partners/spouses and children. The key is to make sure that you're complementing — not duplicating — your primary health insurance.

Learn more

There's a lot to understand about supplemental health insurance, and we want to make sure you have the information you need to make informed decisions. We encourage you to learn more and discuss your unique needs with your local State Farm® agent.

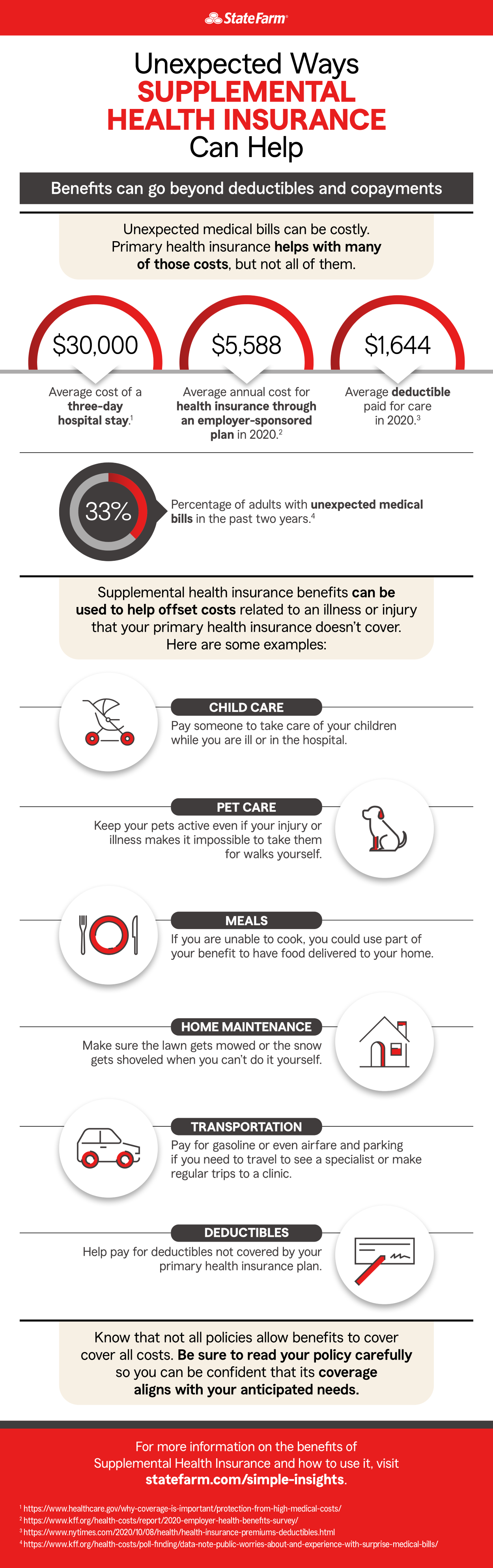

Benefits can go beyond deductibles and copayments

Unexpected medical bills can be costly. Primary health insurance helps with many of those costs, but not all of them.

$30,000: Average cost of a three-day hospital stay1

$5,588: Average annual cost for health insurance through an employer sponsored plan in 20202

$1,644: Average deductible paid for care in 20203

33%: Percentage of adults with unexpected medical bills in the past two years4

Supplemental health insurance benefits can be used to help offset costs related to an illness or injury that your primary health insurance doesn't cover. Here are some examples:

- Child care: Pay for someone to take care of your children while you are ill or in the hospital.

- Pet care: Keep your pets active even if your injury or illness makes it impossible to take them for walks yourself.

- Meals: If you are unable to cook, you could use part of your benefit to have food delivered to your home.

- Home maintenance: Make sure the lawn gets mowed or the snow gets shoveled when you can't do it yourself.

- Transportation: Pay for gasoline or even airfare and parking if you need to travel to see a specialist or make regular trips to a clinic.

- Lost wages: Disability insurance can help offset losses in income if your illness or injury makes it impossible to work.

Know that not all policies allow benefits to cover all costs. Be sure to read your policy carefully so you can be confident that its coverage aligns with your anticipated needs.

For more information on the benefits of Supplemental Health Insurance and how to use it, visit statefarm.com/simple-insights.

1 https://www.healthcare.gov/why-coverage-is-important/protection-from-high-medical-costs/2 https://www.kff.org/health-costs/report/2020-employer-health-benefits-survey/

3 https://www.nytimes.com/2020/10/08/health/health-insurance-premiums-deductibles.html

4 https://www.kff.org/health-costs/poll-finding/data-note-public-worries-about-and-experience-with-surprise-medical-bills/