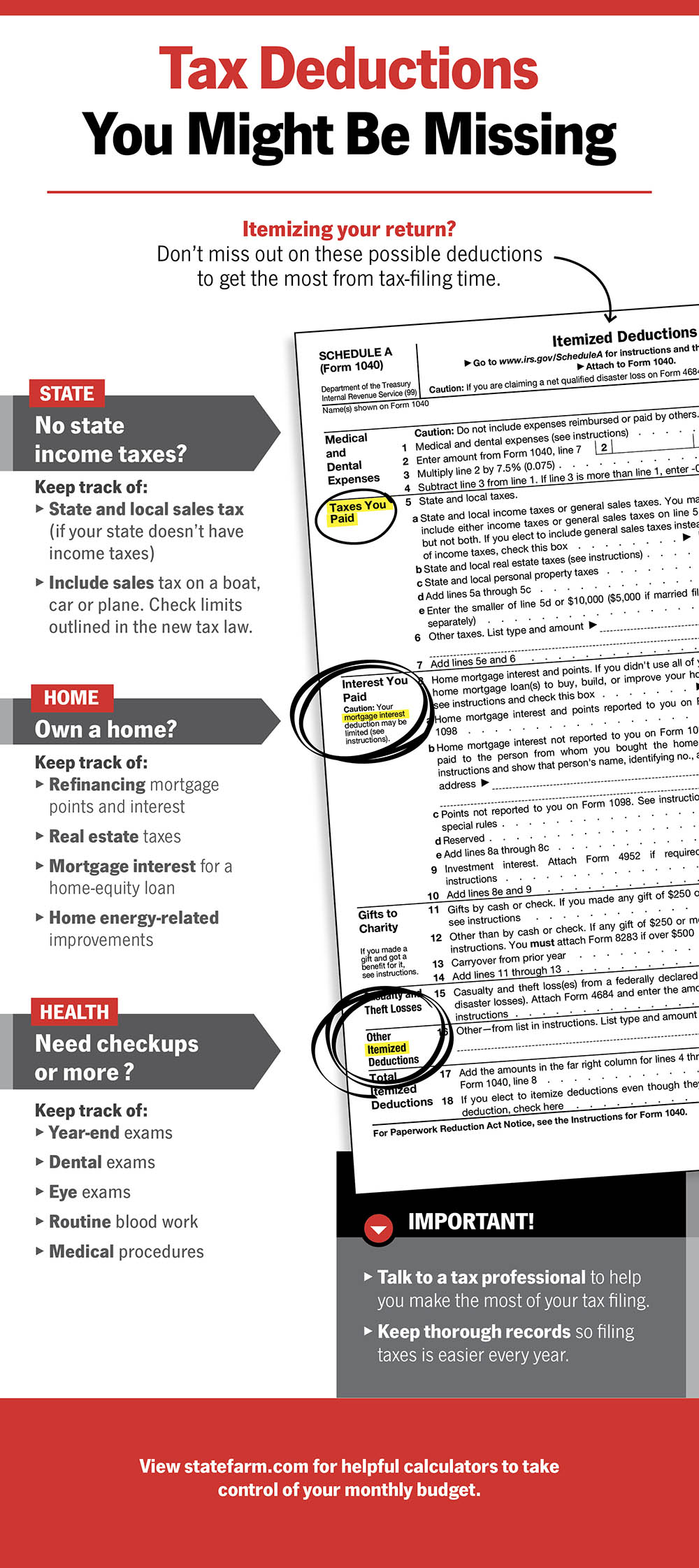

Common tax deductions you might be missing

Check out a few of these tax deduction ideas that may apply to you.

If you are planning to prepare your own taxes, a little tax planning ahead of time will help before you sit down to complete the paperwork. Don't miss out on some of the commonly missed tax deductions. You'll want to get the most from tax-filing time. Here are a few things to consider.

State income tax deduction

Not all states collect state income taxes. If your state does require it, be sure to keep track of:

- State and local sales tax paid (if your state doesn't have income taxes).

- Sales tax on a boat, car or plane paid during the tax year. Check limits outlined in the new tax law.

Homeowner tax deductions

If you own a property or home, be sure to keep track of:

- Refinancing mortgage points and interest paid.

- Real estate taxes paid.

- Mortgage interest for a home-equity loan paid.

- Home energy-related improvement amounts paid.

What medical expenses are tax deductible?

Many health related and medical expenses are deductible. Here are a few.

- Year-end exams

- Dental exams

- Eye exams

- Routine blood work

- Medical procedures

Charitable donations

You might donate money to your church on a regular basis or do a one time donation to a charity here and there. Consider tracking them to be included on your tax return. The IRS has a guide to help you understand what organizations and donation types may be tax deductible. Some of the donations to consider are:

- Money donated to a church or a charitable organization.

- Property given to charities (It’s a good idea to ask for a receipt of donated property).

- Miles driven when helping out a charity.

Retirement contributions

Contributing to your retirement accounts, regardless if you have a 401k plan or an IRA, will lower your overall taxable income. Even though you will end up paying taxes when you withdraw the money in the future, for now those will make your taxable income smaller than if you didn’t contribute to any retirement accounts. Usually, retirement contributions are made with pre-tax dollars. If that is the case, you may not even need to itemize them on your tax return.

Self employment expenses

When you work on your own, whether it be as a freelancer or completing a small side job, there are many business expenses that you may be able to deduct, including:

- Bills for a business cell phone and internet.

- Advertising materials and office supplies needed to run your business.

- Mileage expenses and business travel costs.

- Professional fees like legal and accounting services.

Tax credits

Tax credits are different than tax deductions, and may also help you at tax time by reducing the amount of taxes owed. Some of the known tax credits to keep in mind are:

- Child Tax Credit

- Earned Income Tax Credit

- Child and Dependent Care Credit

- American Opportunity Credit

- Saver’s Credit

Important things to remember at tax time

Whether you decide to complete your taxes on your own or hire a professional, be sure to keep thorough records so filing taxes is easy every year. As you clean out old paperwork, some documents should be saved, others may be shredded. It's important to keep what's truly needed. If you ever have tax questions, it's a good idea to consult a tax professional.

Use these calculators to help you plan and take control of your budget.