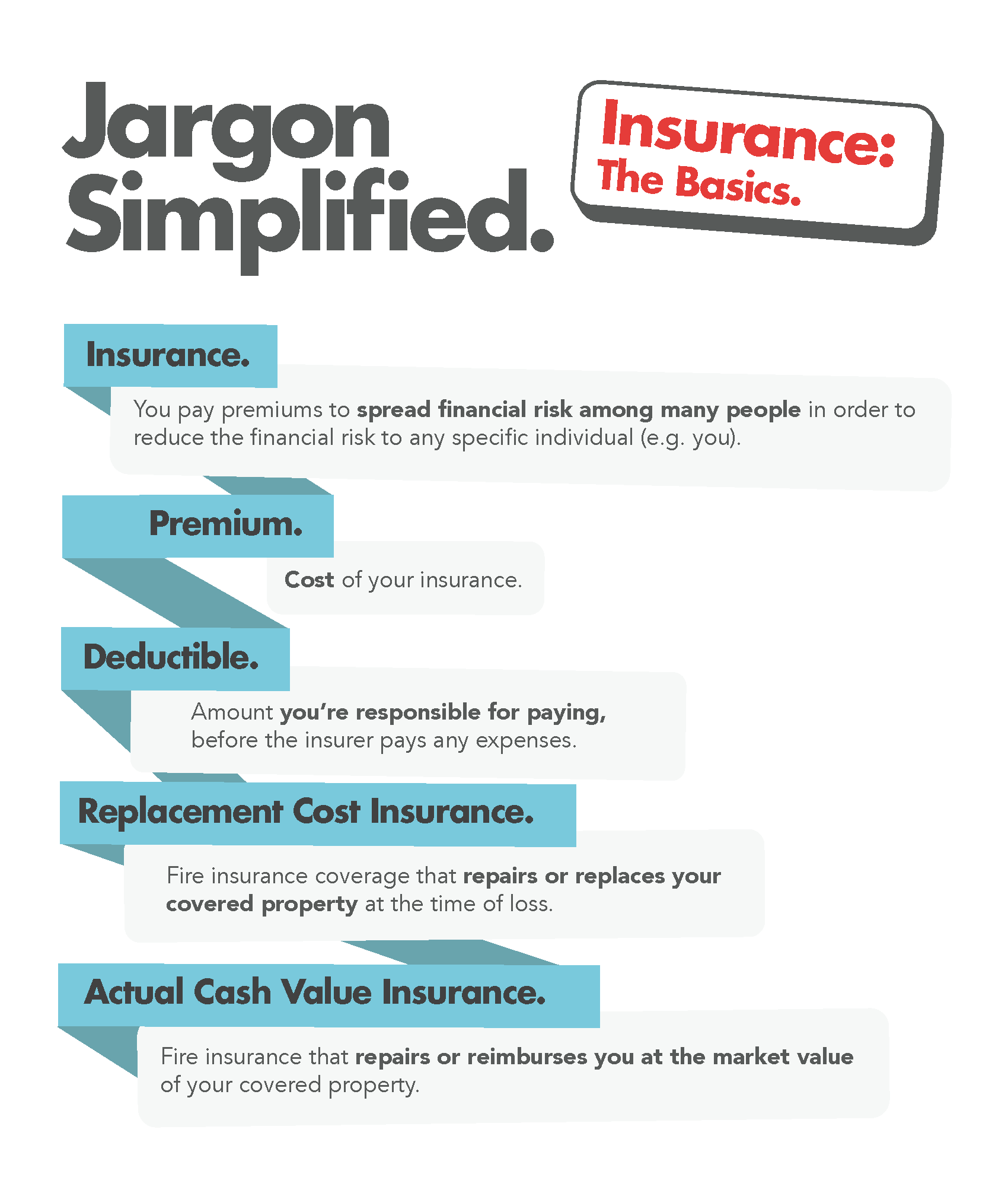

Financial jargon simplified: Insurance basics

Doing some homework to understand important jargon can help you navigate insurance with confidence.

Financial jargon can be confusing to navigate, for both the ‘new-to-managing-my-finances', and even those who are more experienced at it. If you've ever felt like you need a healthy dose of ‘just the facts', you're in luck.

It's time to feel empowered to own your financial conversations. Brushing up on these terms can help you make more informed, confident decisions in your financial life - ultimately getting you to your goals faster and smarter.

You work hard for your stuff. And while we all hope it won't happen to us, sometimes the unexpected pops up. Insuring your stuff, especially if you are a renter, is something you may not be familiar with. Most renters insurance policies cover things like a fire, a break in, or if your stuff gets stolen (at home, or anywhere else). It typically only costs the equivalent of a few coffees a month, and you'll sleep easy knowing that in an emergency you'll be taken care of.

When you're thinking about the coverage you have or need, you'll want to know these insurance basics so you can make informed decisions.

What now?

If you don't have insurance to cover your prized possessions, now might be the time. And if you already have property insurance, double check you have enough in savings to cover any deductible. Get started today by checking out insurance options that cover your stuff.