How to help build credit or improve your credit score

Zero credit or bad credit isn’t an insurmountable hurdle. Here are ideas for how to build good credit.

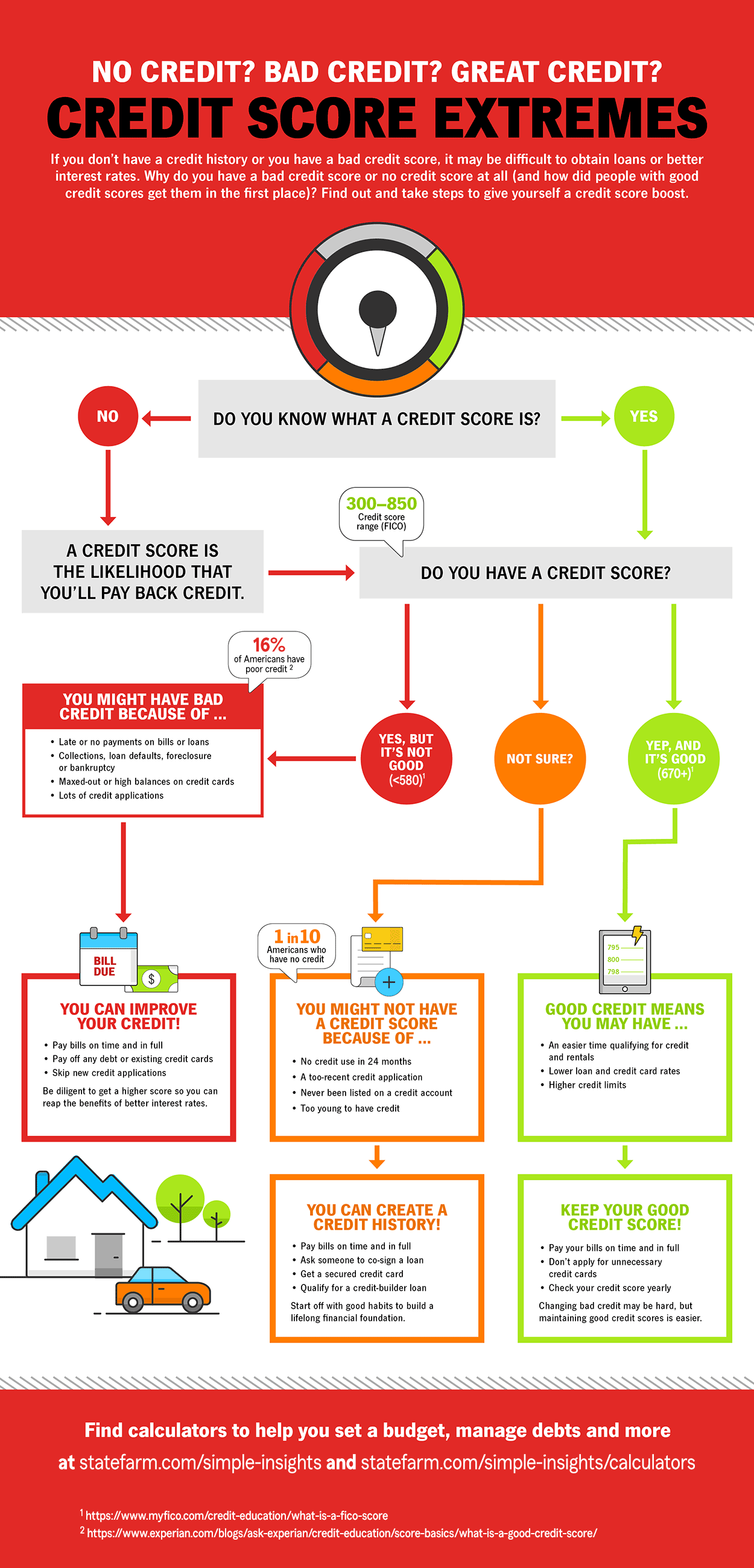

At some point in your life, you may want to borrow money for a house, car or boat, or apply for credit of some type. Having healthy credit can make borrowing easier and cheaper. But for people who may already be struggling with too much debt, a poor credit score may be closer than they think — by leveraging a late bill payment or taking on a new credit card to help bridge a gap. And on the other end of the spectrum, people with no credit history may be unsure what to do to build a solid financial foundation that includes a good credit score.

Your credit score rating determines how much you can borrow and how much it will cost you to borrow. The information used in your credit history is also used as a determining factor not only when obtaining credit and loans, but also can play a part in renting an apartment and purchasing auto insurance.

The steps to either building a credit history or improving a credit score aren’t too difficult, but they do take time.

Do a credit score check

Errors happen, so check your credit report closely for:

- Accounts that aren't yours.

- Accounts with the wrong account date or credit limit listed.

- Names and Social Security numbers that aren't yours.

- Addresses where you've never lived.

- Negative information — like late payments older than seven years (Late payments can only legally stay on your credit report for seven years).

Under the Fair Credit Reporting Act, the three national credit bureaus — Equifax, Experian and TransUnion — along with your creditors, are responsible for correcting errors on your credit report. The Federal Trade Commission (FTC) website has detailed steps for correcting errors, as well as a sample dispute letter.

If you find accounts that aren't yours and suspect you've been the victim of identity theft, it is often recommended to place a fraud alert on your credit report, close those accounts and file a police report and a complaint with the FTC. To provide further protection, State Farm® offers Identity Restoration insurance.

How is a credit score determined?

There are several factors that go in to your credit score. It’s a good idea to understand how these impact your score — both good and bad.

Your payment history: This looks at whether or not you pay your bills on time.

- Tip: Always pay the minimum payment due on time. Signing up for automatic/electronic payments can make this easier to remember.

Your credit utilization ratio: This measures how much credit you use compared to your credit limit.

- Tip: Use less than 30% of your total credit limit — across all your cards. If you use more credit, your credit score may be lowered.

Your length of credit history: This basically means the longer you’ve been paying on time, the better.

- Tip: Instead of canceling old credit cards, consider keeping them open and active, without using them every day. To do this, try setting up a small automatic reoccurring charge that you can easily pay off each month.

Your credit mix: This looks at what types of credit you use: installment (has an end date, think loans) or revolving (has no end date, think credit cards).

- Tip: Don’t worry if you don’t have a mix of these accounts today. Installment accounts likely come with time as you purchase larger items, like a car or a home.

Credit inquiries: This looks at how often you are applying for new credit.

- Tip: Don’t apply for, or close, several credit accounts in a short period of time. Doing so can ding your credit score.

Learn more about credit scores as well as how they are determined and how common each category is.

How to build a credit history

There are several things you can do to start building a credit history.

- Get a secured credit card. This card backs up your credit card with a cash deposit when opening the account. If you fail to make a payment to the card, the card issuer will use the money in the deposit to pay the bill. If you ever close the card, you get your deposit back.

- Become an authorized user on someone else’s card. This will apply the card’s payment history to your credit file – so be sure the primary user has a good history of paying the card on time.

- Be a co-signer – just make sure you both understand that you are both responsible for the full amount owed if it’s not paid.

- Get a credit-builder loan. The lender holds the money in an account until the loan is repaid – then you get the funds.

How to help improve your credit score

Yes, you can improve your credit score! In addition to running annual credit reports, here are a few ideas to consider.

- Open accounts that report to the credit bureaus.

- Pay your credit card or loan bills on time and in full, every month. And if you can’t pay in full, pay at least the minimum due by the due date. If you’ve missed payments, get current and stay current. Each on-time payment has a positive impact on your score. If your payment is 30 days late, it can be reported to the credit bureaus and damage your credit score. Set up auto pay for the minimum amount due then pay additional amounts as you’re able to.

- If possible, pay down credit card debt – or pay it off completely along with any other debt. Your debt-to-credit ratio is used in determining your score – if those numbers are too close, your score can suffer.

- Avoid the temptation to fill out credit applications. Those department stores might offer a discount for opening a card with them, but it isn’t good for your overall credit score — and could take you deeper in to debt.

Ways to use credit wisely

You must use credit regularly for creditors to update your credit report with current, accurate information. While paying with cash or a debit card may make it easier to keep to a budget, a cash-only lifestyle does very little to improve your credit score.

The easiest way to use credit is with a credit card, especially if you're trying to improve your score to qualify for an installment loan. If you have an old credit card, start using it again responsibly. A long credit history is a positive determining factor for your credit score, so making an inactive account active again may be advantageous.

Although you need to make a point to use credit regularly, only charge as much as you can pay off. Keep your credit balances low so as not to damage your debt-to-credit ratio.

Don’t purchase large items you can’t afford now

If you don’t have the money set aside for that flat-screen TV, paying for it with credit will cost you more in the long run. Think of your credit card as an extension of your checking account, and save up the cash for larger purchases before you swipe.

Keep track of spending

Review your monthly statements when they arrive in the mail to make sure nothing looks amiss. This also gives you the chance to note spending patterns and see areas where you can cut back if you’ve struggled to pay your bills.