Checklist for moving into a new house

Tips and tricks for new homeowners to help you know what to do after you buy a house.

Congratulations! You've bought a home. You’re all packed and ready for your big move! Whether it’s your first time or not, you probably feel excited, happy, nervous and maybe a little overwhelmed.

All of that is natural, of course. But preparing yourself with a solid new home checklist can help you happily swing from homeowning newbie to homeowning master in no time. Here are some tips on what to do after buying a house.

Pre-move: Set up for success

Now that you’re a new homeowner, what are the first things you should check off your list before you move?

- Notify your landlord. Inform your landlord of your plans to move out, ensuring you follow the guidelines outlined in your lease agreement.

- Connect your utilities. Confirm that utilities at your previous residence, including internet and TV services, have been canceled.

- Update paperwork. Notify your bank and postal carrier of your new address and update your driver’s license. Check if there’s additional paperwork that needs to reflect your new address as well, such as subscriptions or insurance policies.

- Look at your budget. Establish a budget to help limit overspending and help avoid strain on your finances.

- Clean the house. Thoroughly clean your home, paying special attention to spots that may be hard to reach once your furniture arrives.

- Paint the walls. Assess your walls and try to knock out the paint jobs before you move in if possible.

- Childproof the house. Consider addressing safety risks beforehand if you’re planning on introducing little ones to your new place. You’ll want to look out for sharp corners, review window safety, address wide gaps in elevated railings and take measures to avoid injuries.

- Locate warranty information. Look or ask for the warranty information that is attached to appliances that remain in the house if your new home was owned by previous residents.

- Turn on the HVAC system. Test your system by setting it to auto-regulate and your desired temperature. Let it run for a bit and monitor its performance to confirm it’s ready for move-in day.

- Change the locks. Replacing the locks or have them professionally rekeyed to prevent old keys from granting access to your home is a good practice if you’re taking over from a previous owner. There are a few different types of door locks available, so consider doing some research before making a choice.

- Install a home security system. While not necessary, taking steps to improve your home security can help defend your home, family and belongings.

- Flush the toilets. This can help clean out the system and help you confirm that they’re working properly.

- Test safety devices. Keeping your smoke detectors and carbon monoxide detectors functional may help protect you and your new investment. Don’t forget to check the batteries and replace them if needed.

- Plan for emergencies. Should something arise, you’ll want to be prepared with an emergency kit and a fire escape plan.

- Flip the light switches. Quickly flip through the light switches to see that they’re operational without any flickering or sparking.

- Test the outlets. Try using something that can be immediately verified, like a phone charger or radio, to confirm that outlets are working properly.

- Run hot water. Test the hot water tap on all the faucets to confirm that the water heater is in working order.

- Check faucets for leaks. Run each one, check for water pressure and monitor for leaks above the sink and the pipes below.

- Inspect and label the circuit breaker. Flip the switches back and forth, taking note of what part of the house each one correlates to. This gives you a chance to label each one for future reference while also confirming that they work.

- Do a final walkthrough. Keep an eye out for anything else that you might want to address before your official move-in date.

- Plan to move your belongings. Devise a strategy as to how you’re going to move, including organizing your things and deciding if hiring a mover is right for you or if portable moving containers may be needed.

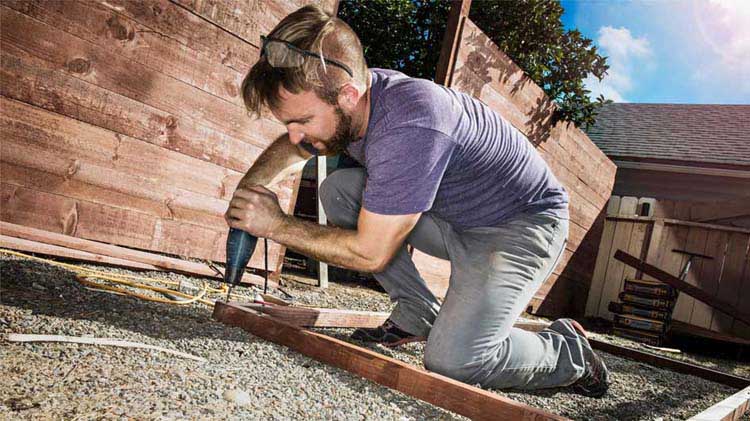

Some of these projects may be more work than you’re able to do during your move. Remember that you don’t always have to do it alone; for tougher work, think about hiring a professional to help.

Do you need moving insurance?

If a moving company is involved, they will likely provide you with some type of insurance, but coverages could vary. If you are moving yourself, your existing homeowners or auto insurance may offer limited coverage. Ask an agent if moving insurance is right for you.

Moving: Get settled

You may be anxious to get started on home improvement — but it's also OK to unpack your boxes and get to know the ins and outs of your rooms and your yard. Take some time to enjoy your new home and prioritize projects once you start to get settled. What spaces do you use the most? As you begin to get organized and think about what your home might look like, ask friends and family what projects they're glad they took on and what they wish they would have done differently. Remember, you've got plenty of time to tackle the to-do list!

What to do once you’ve moved in:

- Confirm inventory. Once you have all your belongings moved over, check that each of your items has arrived.

- Handle trash. You’ve likely built up a decent amount of trash and recycling during your move, check with either the sellers or your neighbors to know when trash and recycling pickup days are.

- Check appliances. See that each one is functioning properly and consider if you’d like to make upgrades.

- Go shopping. There can be a variety of things new homeowners need to buy like a vacuum cleaner, first-aid kit, flashlight or a fresh set of silverware.

- Tackle renovations and landscaping. While you’re in the rhythm of getting things done for your home, think about tackling some renovation and landscaping projects.

- Update your insurance. Check if you’re up to date with all of your insurance policies and whether or not you need to make insurance changes. For example, if you currently have renters insurance, you’ll now switch to a homeowners insurance policy. If you have a mortgage, the lender will require insurance and being uninsured is a major risk that could leave you financially vulnerable, especially after making a major purchase like your new home.

- Explore your new neighborhood. Walk around to get a feel for the area and meet your new neighbors. Moving is a great time to get to know people in the community. You can also take a drive to check out some of the important aspects of the neighborhood like the closest banks, grocery stores, public parks and other places of interest.

- Get involved in volunteering. Volunteering is another great way to make connections in a new place. It could also give you deeper insights into the dynamics of your new community.

Home improvement: Dream big, start small

Once you’re settled, make a master list of projects you’d like to complete in the future. You may have some remaining to-do items from your home inspection that should be added to the list. Once you have a list, you can prioritize, estimate budgets, start saving and then start doing.

Maintenance: Fix it up

Implement a seasonal inspection routine: Walk around the exterior of your home, then do the same for the interior. Add items that need immediate attention to your to-do list, including dripping faucets and home appliances. Put dates in your calendar for reminders such as “change furnace filter” and "complete a fire inspection" based on manufacturer or generally accepted recommendations.

Budget: Plan and save, then plan some more

In addition to budgeting for a mortgage, property tax and insurance payments, setting aside funds for both short- and long-term projects, as well as planned and unplanned maintenance, may be a good idea. Zillow estimates the monthly expenditure at about $1,180 — but it all depends on the size, condition and location of your home. Also consider whether you'll do some improvements or maintenance pieces, such as lawn care, yourself; if you do, look at investing in the right equipment and pay to have that serviced, too.

Insurance: Inventory your stuff

After purchasing your homeowners insurance, it's a good idea to spend time taking stock of what you own by creating a home inventory. Online options can help, or you can simply photograph each room and record its contents. Once you're done, contact your State Farm® agent to see that your coverage levels are adequate. While it’s on your mind, consider setting a reminder to check on your homeowners insurance annually.

Owning your first home is a significant milestone, filled with both excitement and responsibility. By following these tips, you should be well on your way to transforming your new place into a comfortable, well-maintained and secure home. Welcome to homeownership!

The information in this article was obtained from various sources not associated with State Farm® (including State Farm Mutual Automobile Insurance Company and its subsidiaries and affiliates). While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third-party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.

State Farm Fire and Casualty Company

State Farm General Insurance Company

Bloomington, IL

State Farm Florida Insurance Company

Tallahassee, FL

State Farm Lloyds

Richardson, TX