Simple Insights® from State Farm®

Looking for help protecting your family, cars, home and future? You've come to the right place. Articles from Simple Insights draw on over 100 years of State Farm knowledge.

Trending

Auto and Vehicles

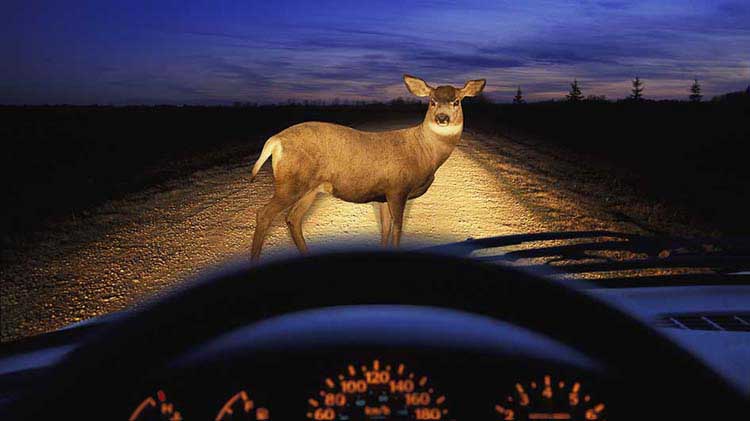

What to do when you hit a deer

Even if you're vigilant, auto-deer collisions can happen. Learn what to do next.

Residence

How to prevent pipes from freezing

Consider these ideas to help prevent frozen pipes — and what you might try if they do freeze.

Auto and Vehicles

Why are auto insurance rates going up?

Reasons behind rising car insurance premiums and ways to help manage them.

Auto and Vehicles

How much car insurance do I need?

Learn about coverage limits, collision and comprehensive, deductibles and other important terms to help decide on how much is right for you and how you can save.

Auto and Vehicles

What affects car insurance rates?

Know the factors affecting car insurance premiums and learn ways to help lower insurance costs.

Auto and Vehicles

Can you drive safely in severe weather?

It's helpful to know how to drive safely in ice, snow, rain, fog and other inclement weather.

Auto and Vehicles

Can you really save if you choose to bundle insurance?

It’s more than likely. And savings aren’t the only advantage of bundling insurance.

Popular

Auto and Vehicles

Can someone else drive my car?

Discover what happens if someone else drives your car and gets into an accident.

Residence

Pros and cons of metal roofs for your home

Whether you're buying a home with one or thinking of installing, here's what to know.

Auto and Vehicles

Obtain an electronic proof of insurance card

You can keep rummaging through your glove compartment. Or you can choose a better option: a digital insurance card.

Residence

What is homeowners insurance and what does it cover?

After investing in your home, it's important to have it insured properly. What are all the policy coverages, forms and exclusions?

Find other articles by category

Latest

Residence

Ways to help add value to your home

Check out some ways to add value to your home, whether you are looking to stay and upgrade or enhance and sell.

Residence

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Residence

Building vs buying a home: Which is more cost-effective?

What are the benefits and costs associated with building a new home vs buying an existing home?

Calculators

These calculators may bring you more confidence with your financial decisions.

Auto and Vehicles

Calculate your vehicle depreciation

Determine how your vehicle's value will change over the time you own it using this tool.

Auto and Vehicles

Tips to help decide which auto loan might be the better deal

Purchasing a car? Here's a car loan calculator to help you compare and decide which loan may be best for you.

Auto and Vehicles

Calculate whether to buy or lease a car

Enter the details of the purchase and lease options to help decide if buying or leasing a car is right for you.

Auto and Vehicles

Should I finance a car or pay cash for it?

This auto calculator could help you find out what might be the best move for you.

The information in this article was obtained from various sources not associated with State Farm® (including State Farm Mutual Automobile Insurance Company and its subsidiaries and affiliates). While we believe it to be reliable and accurate, we do not warrant the accuracy or reliability of the information. State Farm is not responsible for, and does not endorse or approve, either implicitly or explicitly, the content of any third party sites that might be hyperlinked from this page. The information is not intended to replace manuals, instructions or information provided by a manufacturer or the advice of a qualified professional, or to affect coverage under any applicable insurance policy. These suggestions are not a complete list of every loss control measure. State Farm makes no guarantees of results from use of this information.