What is a checking account and how to use it

Learn the basics about how to write and cash checks, locate the bank routing number and more.

Checking account definition

Checking accounts are typically accounts that have unlimited transactions that allow you to manage your daily finances for depositing and withdrawing funds. To deposit funds, you may have multiple options including direct deposit from an employer, transfer money from other bank accounts, deposit checks using mobile deposit or any other options your bank allows. To withdraw funds, you can use checks, debit card, bill pay or establish electronic Automated Clearing House (ACH) debits.

Checking account costs can differ between banks and different checking account types within the same bank. Some accounts are low or no fee while others may have fees or balance requirements to avoid fees. Review the features carefully to determine which checking account you would like to apply for. Some companies allow you to apply online for an account.

Checking accounts opened at a bank are protected by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per insured bank. In the case of a checking account opened at a credit union, those are typically protected by the National Credit Union Administration (NCUA).

Some information about checks

How to write a check

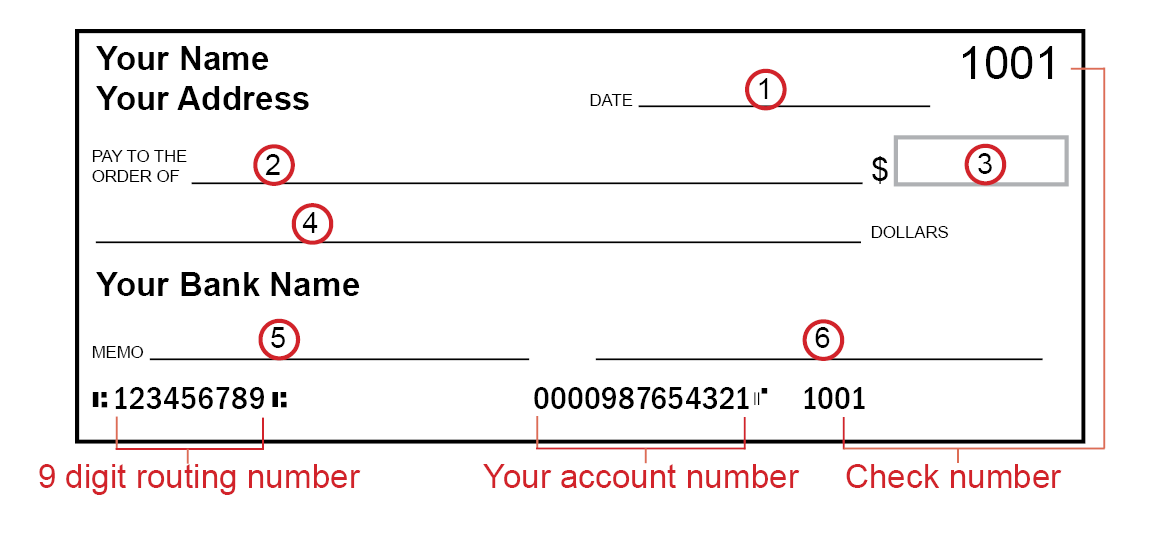

Writing a check is easy! Using the check example below, we explain how each field is completed.

- Write today's date in the space in the upper right-hand corner. You can post-date it in advance for when you'd like the payee to draw funds, but the payee isn't obligated to honor it. It's best to make sure you have enough money in your checking account on the date you write the check.

- On the "Pay to the Order Of" line, clearly print the name of the person or business you're writing the check to.

- Write the numerical amount of the check in the small box. For example, "12.52." You don't need to include the dollar sign since it's already printed on your check.

- On the "DOLLARS" line, write out the same amount you wrote in the box above (#3), only this time in words. For example, write, "Twelve dollars and 52/100." If the dollar amount doesn't have any cents, write 00/100. If space remains, draw a line to fill out the space to help prevent tampering.

- The memo line is the only optional area to fill out on a check. You may leave it blank, however, it's a great way for you to keep track of what the check is for or to write in an account number. For example, you can write in something like, "groceries."

- Sign your name on the bottom right-hand line. Signing your check gives authorization to the payee to draw the specified amount from your checking account.

What are the numbers at the bottom of a check?

There are three sets of numbers located at the bottom of your checks: the bank routing number, your checking account number and your check number.

Bank routing number – The first set of numbers is the bank routing number, which is a nine-digit code that is specific to the bank where you have your checking account. Routing numbers are used to transfer money between financial institutions, banks and credit unions. Some common transactions include wire transfers, electronic bill payments and direct deposits.

Checking account number – The second set of numbers on the check is your checking account number. Unlike the routing number, this number is personal and can only be found on your check or banking statement.

Check number – The last set of numbers is your check number. It represents the number that appears in the upper right-hand corner of your check and is used to keep track of the checks you've written.

Handling an unused check

What happens if you fill out a check and you no longer need it? You'll have to void that check, even if it's only partially filled out. Voiding a check helps ensure that no one else can complete the check or otherwise process it. To void a check, simply write, "VOID," in large letters across the whole length of the check. You can then either keep it for your records or shred the check to dispose of it.

How do I deposit a check?

In the designated endorsement area on the back of the check, sign your name and write: "For deposit only" (to help prevent anyone from cashing it). You can then deposit the check at your bank's branch or ATM. The bank may require you to fill out a deposit slip, which you can get at your bank or in the back of your book of checks.

Many banks also allow you to deposit a check online or do a mobile deposit. You may need to take a picture of it and follow steps indicated by your bank’s app.

How do I cash a check?

To receive cash, you may present the check at the financial institution the check is drawn on (the writer’s bank) by signing your name on the back and providing identification. You may also take the check to your bank to have it cashed by signing your name on the back, but you may need to have funds to cover the amount should the writer not have enough funds available.

Checking account features

- Bill pay – Gives you the option of making payments electronically either on a single or recurring basis. This typically requires a one-time setup for each account to be paid. Thereafter you select the account, amount and date when you'd like your payment made.

- Mobile deposit – Allows you the flexibility to deposit a check by taking a picture using a cell phone or tablet.

- Electronic statements – Traditionally, checking account statements were provided in paper, but now you can select an option to go paperless and receive them electronically.

- Debit cards – Checking accounts usually give you the option to have a debit card that you can use to withdraw money from your account at ATM machines, as well as to make purchases online or at stores.

- Wire transfers – This feature allows you to transfer or receive large amounts of money from accounts, including from another country. Your bank may charge a fee for the transaction.

- Mobile wallet capabilities – Many checking accounts offer the possibility of connecting your bank account or debit card to your mobile wallet like Apple Pay or Google Pay.

What are insufficient funds?

Insufficient funds means that you have made payments from your account but don’t have enough money to cover the payments. This can happen when a check is cashed, an automatic payment is withdrawn, you made a transfer or used your debit card, and the available balance isn’t enough to cover it. When your account has insufficient funds (NSF) you may incur fees from your bank, and in some cases the entity trying to take payment from you may charge a fee, too. The key is knowing your account balance before making any type of payment.

What is overdraft protection?

Overdraft protection is an agreement with your bank where they offer to cover an overdraft on your checking account temporarily, so your checks or payments don’t bounce if you have insufficient funds at the time of a transaction. There is usually a fee charged to you if overdraft protection is used, and it might have a specific predetermined amount. Confirm with your bank that this is a service offered for the type of checking account you have.

Checking account vs savings account

Both checking and savings accounts allow you to deposit money, and usually are offered by banks and credit unions. Each of them has different purposes and features.

- Checking accounts – Mainly used for spending money that you have in it, such as paying for expenses like rent or mortgage, car payments, groceries, credit card payments and gas. As mentioned before, you can issue checks, schedule payments and depending on the checking account type, have unlimited transactions a month. Some checking accounts may have a very small interest rate or in some cases no interest rate will be offered.

- Savings accounts – Mainly used for saving money that you are not planning to spend right away. These types of accounts may have more strict rules about the number of transactions you can make every month and may offer a higher interest rate.

Keep your checking account safe

Store your checkbook and extra checks in a secure location just as you would if it were actual cash. Also keep your online banking access secure, including protecting your password and cell phone. You don't want the wrong person to get a hold of your checking account number, write checks on your behalf, unlawfully gain online access to your account or use your debit card or mobile wallet.

It’s a good practice to balance your checkbook and monitor your account regularly. Notify your bank immediately of any suspicious activity.

Now that you have read information about checking accounts, you may also want to learn about different kinds of savings or understand how savings accounts work.