How much life insurance do you need?

Use our life insurance calculator to help determine the right amount for you.

State Farm Life Insurance Company or State Farm Life and Accident Assurance Company (residents of NY and WI only) can help you find coverage that's right for you and your loved ones.

If interested in discussing your life insurance needs, please contact a State Farm® Agent.

Use our life insurance calculator to help determine the right amount for you.

Life insurance helps your life’s moments live on. Whether it keeps paying the mortgage, maintains a current standard of living, pays off debts or pays for college, the life insurance you choose can be there when it’s needed most by your loved ones.

Need coverage for a specific time frame? Term life helps with short-term debts, added protection during child-raising years and more.

This permanent policy protects your family’s future while building cash value that grows tax-deferred. Premiums remain level for the life of the policy.

This permanent policy with flexible premium payments and death benefits can help protect your loved ones while building tax-deferred cash value.

There’s a State Farm agent nearby ready to offer personalized service to fit your specific needs.

Whether you're looking for the affordability of term insurance, the lifelong protection and cash value of permanent insurance, or a combination of both, we have options to fit your needs and budget. Decide which coverage is right for you before getting a life insurance quote.

| Permanent life | Term life |

|---|---|

| Provides lifetime coverage, if premiums are paid. | Provides coverage for a limited time period (term), if premiums are paid. |

| Cash value accumulates over time and creates an asset which may be use during your lifetime.footnote 1 | Provides a death benefit, but typically no cash value. |

| Level premiums. | Initially, less expensive form of life insurance. |

| Some types of permanent insurance offer flexible premium payments and level or increasing death benefit options. | May be renewable or convertible. |

| Permanent life |

|---|

| Provides lifetime coverage, if premiums are paid. |

| Cash value accumulates over time and creates an asset which may be use during your lifetime.footnote 1 |

| Level premiums. |

| Some types of permanent insurance offer flexible premium payments and level or increasing death benefit options. |

| Term life |

|---|

| Provides coverage for a limited time period (term), if premiums are paid. |

| Provides a death benefit, but typically no cash value. |

| Initially, less expensive form of life insurance. |

| May be renewable or convertible. |

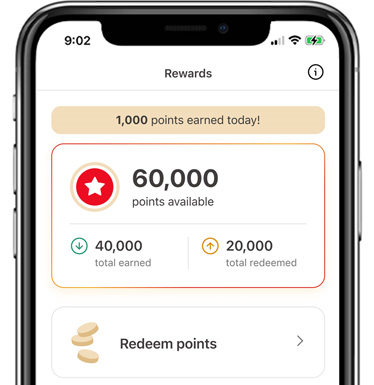

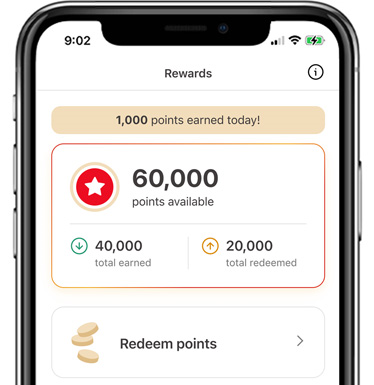

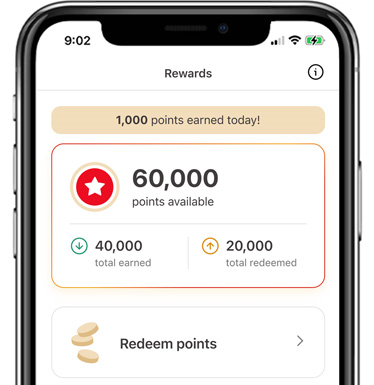

Designed to help State Farm Life Insurance customers, Life Enhanced® is an app that can help you move more and feel better.footnote 2

Thinking about making a change to a policy or beneficiary? Your State Farm agent would be happy to assist you. But you can also initiate a change yourself.

You’ve built your business. We want to help you protect it with such options as Group Life insurance or policies for key employees or business continuation.

A State Farm insurance agent can help you choose the right products, options, and coverage amounts. And with more than 19,000 agents throughout the U.S., chances are there’s one near you.

Pick from three simple options if you need to file a life insurance claim. Already got a key code? Complete the beneficiary form online.

By phone — Contact your State Farm agent or the Life Response Center at 877-292-0398.

Online — Report your claim

Want more life insurance information? Get the basics and beyond. From articles and money-saving tips to estate planning, find the answers you need.

return to reference 1 Permanent life insurance develops cash value that can be borrowed. Policy loans accrue interest and unpaid policy loans and interest will reduce the death benefit and cash value of the policy. The amount of cash value available will generally depend on the type of permanent policy purchase, the amount of coverage purchase, the length of time the policy has been in force and any outstanding policy loans. There may be tax consequences associated with policy loans.

return to reference 2 Benefit available for State Farm customers who have purchased a new life insurance policy since January 1, 2022. While anyone over 18 years of age can join Life Enhanced, certain app features, including rewards, may not be available unless you own an eligible State Farm life insurance policy. At this time, policyholders in Florida, New York, and South Dakota are not eligible for the full program. Please note that some policyholders may experience a delay before a new policy is eligible for rewards.

This is only a general description of coverage. A complete statement of coverage is found only in the policy.

Insurance policies and/or associated riders and features may not be available in all states, and policy terms and conditions may vary by state.

Neither State Farm nor its agents provide tax or legal advice.

For more details on coverage, costs, restrictions, and renewability, or to apply for coverage, contact a local State Farm agent.

Each State Farm insurer has sole financial responsibility for its own products.

State Farm Life Insurance Company (Not licensed in MA, NY or WI)

State Farm Life and Accident Assurance Company (Licensed in NY and WI)

Bloomington, IL

IL-2.20